The “Barbarous Relic” Helped Enable a World More Civilized than Today’s

https://mises.org/wire/barbarous-relic-helped-enable-world-more-civilized-todays

12/12/2022George Ford Smith

MD: The Mises Monks are always great fodder for illustrating the spread of confusion and delusions as to what money “really” is. Let’s dissect this one.

One of history’s greatest ironies is that gold detractors refer to the metal as the barbarous relic. In fact, the abandonment of gold has put civilization as we know it at risk of extinction.

MD: How’s that for an opening line? The Monks never disappoint. “Greatest Ironies”; “gold detractors”;” barbarous relic”: Yet they never seem to be able to tell us what money really is. But this may be going too far. Removing “gold” will “risk extinctions”?

Gold’s main use is in jewelry and plating electrical contacts. Once used to fill teeth, it’s been a very long time since gold was used for that (except for Negros who use it to decorate their faces.) And in no lifetime of anyone living today has gold served as money. And silver ceased serving as money in 1965…almost 10 years before Nixon declared the obvious…that the so-called gold backing of the dollar was a giant fiction…a fraud on which the French called them out.

The only risk to extinction was use of mercury amalgamating silver to fill teeth. It was shown to be poison…like lead in paint and gasoline. Precious metals have never been money. They are just clumsy expensive stand-ins for what money really is…”a promise”. And what do these Monks call real money? They call it “fiat money”…and make it a derogatory slur. Since when is a “promise” derogatory. Let’s continue.

The gold coin standard that had served Western economies so brilliantly throughout most of the nineteenth century hit a brick wall in 1914 and was never able to recover, or so the story goes. As the Great War began, Europe turned from prosperity to destruction, or more precisely, toward prosperity for some and destruction for the rest. The gold coin standard had to be ditched for such a prodigious undertaking.

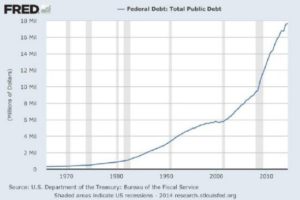

MD: Served economies “brilliantly”? Economic panics were as regular then as pandemics are becoming today. And in 1913 (a year before this so-called brick wall), the Federal Reserve Act began to plague us with the money we have today…a money that States freely counterfeit…and that money-changers collect interest on…and that both manipulate to deliver the so-called “business cycle”. “Prodigious undertaking”? Oh please!

If gold was money, and wars cost money, how was this even possible?

MD: A Mises Monk might be close to getting something right here. You can’t support a war if you can’t pay for it. And if gold is money…with only about one ounce per person on Earth (less than $2,000)…you’re not going to support war with gold. But you can by counterfeiting. They claim Lincoln did this to finance the USA Civil War in the 1860’s…and that’s correct. But when that counterfeit money (Greenbacks) was paid back, it ceased to be counterfeit. It “proved” to be “real” money. That hasn’t happened with any war since. The State just rolls its counterfeit money over by taking out new loans to pay off the old.

First, people were already in the habit of using money substitutes instead of money itself—banknotes instead of the gold coins they represented. People found it more convenient to carry paper around in their pockets than gold coins. Over time the paper itself came to be regarded as money, while gold became a clunky inconvenience from the old days.

MD: Well, the Monks being right didn’t last long did it? Here at Money Delusions we know money is an “in-process promise to complete a trade spanning time and space”. It is only created by traders like you and me. It begins as a ledger entry…open to all to see. And it ends with delivery on the promise and reversal of that ledger entry documenting the promise…again for all to see. In the interim it may remain a ledger entry; it may become a “demand deposit” (i.e. check); it may become a paper chit (currency); it may become a token (a coin). As such, it becomes the most common object of every simple barter exchange. But in the end it becomes a reversing entry in a ledger and is extinguished forever…for that trading promise. And if the promise is broken (defaulted) an “interest collection” of like amount is immediately made to recover the “orphaned” money. This guarantees perpetual perfect balance of supply and demand for the money itself…and thus zero “inflation”.

Second, banks had been in the habit of issuing more bank-notes and deposits than the value of the gold in their vaults. On occasion, this practice would arouse public suspicion that the notes were promises the banks could not keep. The courts sided with the banks and allowed them to suspend note redemption while staying in business, thus strengthening the government-bank alliance. Since the courts ruled that deposits belonged to the banks, bankers could not be accused of embezzlement. The occasional bank runs that erupted were interpreted as a self-fulfilling prophecy. If people lined up to withdraw their money because they believed their bank was insolvent, the bank soon would be. People had no idea their banks were loaning out most of their deposits. They did not know fractional reserve banking, a form of counterfeiting, was the norm.

MD: That’s not a “habit”…it’s by design. Money-changers instituted the State. The State chartered the Banks (owned by the Money-changers)…and gave them a 10x leverage advantage over traders like you and me. And when those scoundrels abused even that enormous privilege, the State they created defended them…as designed. It’s not a government-bank alliance. The State is a “creation and tool” of the Money-changers. And the State fiction of Laws sealed the deal. They pass one law that dilutes the golden rule and bammo…everything else that isn’t against the law (but violates the golden rule) is suddenly legal. And that obvious problem created here brings us 40,000 new laws each year…trying to put the Genie back in the bottle…trying to make us comply with that one simple golden rule.

And why didn’t the people know this was going on? Because there was “secrecy” in banking. Money requires “authentication” of the trader creating it and “transparency” of the promise to all lookers. And “defaults” are evident to all lookers “immediately”…and immediately mitigated by “interest collections” of like amount.

Here again, the Monks get close to saying what’s going down. Money “is” fiat…and that’s good. It’s what makes it so efficient in trade. But a “real” money process gives “no” trader an advantage…not even the Money-changers; their States; or their Banks. In this context, the “fraction” is not 10x…but rather infinite to the trader. And there is no reserve. Unlike a water well, you don’t have to prime the pump. But if you don’t replace the water you pump, you don’t get to pump again…until you replace that water. Lots of metaphors going on here.

Gold coin redemption requirements put limits on fractional reserve banking. Such limits were not welcomed by banks. Since banks could loan to the government, limitations also capped government spending, so the government did not like the limitations of gold coin redemption either.

MD: What “coin redemption requirements”? They were always a fiction. Gold coins were never used in my lifetime. And silver coins quit being used in 1964…and changed nothing in the behavior of traders… proving that precious metal was not money. Rather, it was the “token” that was money. At the same time, the paper money which said “Silver Certificate” changed to saying “Federal Reserve Note”…and as far as traders like you and me were concerned, nothing changed.

We never asked for the silver promised by those certificates. We had no use for it. It weighed too much and was too bulky. But for non-traders, the change was large. These non-traders are called “investors”. They’re really just gamblers. And they immediately gobbled up all the silver. You can now buy it on eBay (google “Silver Roosevelt Dimes 90% Junk Constitutional Circulated *Guaranteed Cheapest!”). It sells for (i.e. trades for) $4.50 for 10 dimes…dimes that used to trade for two candy bars…before State counterfeiting withered the dollar to its current condition.

And “government limitations”? Does anyone really believe there is such a thing as a government limitation? All governments are by their very definition “unlimited”!

Which brings us to the wall gold allegedly hit.

Preparing for War Means Preparing for Inflation

In his 1949 book, Economics and the Public Welfare, economist Benjamin Anderson tells us, “the war [in 1914] came as a great shock, not only to the masses of the American people, but also to most well-informed Americans—and, for that matter, to most Europeans.” And yet, Germany, Russia, and France began accumulating gold prior to the war (with Germany starting first in 1912). Gold was taken “out of the hands of the people” and carried to the reserves of the Reichsbank, the German central bank. People were given paper notes “to take the place of gold in circulation.”

MD: It goes all the way back to the Battle of Waterloo! … and for all time before that! All wars are “bankers” wars (i.e. money-changer wars). And if they had a “real money process” back then, they could have taken up all the gold they wanted. Traders had no use for it. There are no “reserves” in a real money process. It’s promises with which we deal. The only thing that can destroy a promise is to destroy the record of the promise…or destroy the person who made the promise. And a “real money process” mitigates such contingencies with “interest collections of like amount.” It’s simple arithmetic. Who pays the interest? Only traders who have a propensity to default pay it. And those traders have to work that much harder if they want to continue to trade at all, because once the defaults get too large, the marketplace ostracizes them.

When war broke out in August 1914, Gary North explains that the pre–World War I policy of gold coin redemption was

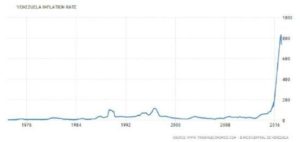

independently but almost simultaneously revoked by European governments. . . . They all then resorted to monetary inflation. This was a way to conceal from the public the true costs of the war. They imposed an inflation tax, and could then blame any price hikes on unpatriotic price gouging. This rested on widespread ignorance regarding economic cause and effects regarding monetary inflation and price inflation. They could not have done this if citizens had possessed the pre-war right to demand payment in gold coins at a fixed rate. They would have made a run on the banks. Governments could not have inflated without reneging on their promises to redeem their currencies for gold coins. So, they reneged while they still had the gold. Better early contract-breaking than late, they concluded.

MD: Earth to Monks. You just made our case. You’ve shown that precious metals are no cure to State deviance and malfeasance. A “real money process” has no State sponsorship. It has no Money-changer sponsorship. It has only trader and their marketplace sponsorship. And it depends on “authenticating” the trader and “accounting” for the trader’s promises. By the classical triple “A”s of trade: (1) Authentication; (2) Authority; (3) Accounting; all “responsible” traders (i.e. those with no propensity to default) have equal “authority” to create money. Those with non-zero propensity to default pay insurance “premiums” which are called “interest collections”. And they’re not arbitrarily set in the smokey rooms of LIBOR . They always equal “defaults incurred”. I’ve always wondered why banks always tell us the “prevailing interest”…but never show us the “prevailing defaults”. Now I no longer wonder. It enables their “business cycle”. It enables the “front running”of economic perturbations they themselves cause by “throttling” the money supply …supposedly in the interest of controlling inflation (which they cause) and maintaining full employment (which they can’t control at all).

If governments had not broken their promise to redeem paper notes for gold coins, they would have had to negotiate their differences rather than engage in one of the deadliest wars in history. Abandoning the gold coin standard, which had always been under government control, was the deciding factor in going to war.

MD: Duh! How about we do an “iterative secession”. How about we do without government altogether.

Though the US did not formally abandon gold during its late participation in the war, it discouraged redemption while roughly doubling the money supply. Blanchard Economic Research discusses the situation in “War and Inflation”:

MD: If gold is money, how did they “double” the money supply? These Monks are beyond stupid. In a “real money process”, you can only double money supply by doubling trader promises. And traders don’t make promises they can’t see clear to delivering. But get rid of government and the money-changers that create it and bammo…a doubling of trade would be minuscule.

War also causes the type of inflation that results from a rapid expansion of money and credit. “In World War I, the American people were characteristically unwilling to finance the total war effort out of increased taxes. This had been true in the Civil War and would also be so in World War II and the Vietnam War. Much of the expenditures in World War I, were financed out of the inflationary increases in the money supply.”

MD: When it comes to money, there’s only one type of inflation. That is when supply exceeds demand for the money itself. And this is impossible in a “real money process”. And as we pointed out earlier, the Civil War was different from all following wars. The Greenbacks were “all” recovered (“Greenbacks then became freely convertible into gold“)

Governments had a choice to make: fight a long, bloody war for specious reasons, or retain the gold coin standard. They chose war. US leaders found their decision irresistible. It was not J.P. Morgan, Woodrow Wilson, Edward Mandell House, or Benjamin Strong who would be fighting in the trenches.

MD: Wars happen when the money-changers’ “economic hitmen” fail. See “The New Confessions of an Economic Hitman” by Perkins.

When we hear that “going off gold” was the prerequisite for global peace and harmony, we should remember places such as the Meuse-Argonne American Cemetery in France, where grave markers seemingly extend to infinity. These are mostly the graves of young men who died for nothing but the lies of politicians and the profits of the politically connected. Gold wanted no part in the slaughter. But politicians and bankers knew a paper fiat standard was the monetary prerequisite to achieving their goals.

MD: Every time I ask one of the Mises Monks how you can use gold as money when there’s only one ounce per person on Earth? …i.e. less than $2,000…1/2 what someone at Home Depot makes in a month! The line goes dead.

Conclusion

John Maynard Keynes, who coined the term “barbarous relic” in reference to the gold standard, wrote about the world that was lost when gold was abandoned:

What an extraordinary episode in the economic progress of man that age was which came to an end in August, 1914! . . . The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, in such quantity as he might see fit, and reasonably expect their early delivery upon his doorstep. . . . He could secure forthwith, if he wished it, cheap and comfortable means of transit to any country or climate without passport or other formality, could despatch his servant to the neighboring office of a bank for such supply of the precious metals as might seem convenient, and could then proceed abroad to foreign quarters, without knowledge of their religion, language, or customs, bearing coined wealth upon his person, and would consider himself greatly aggrieved and much surprised at the least interference. But, most important of all, he regarded this state of affairs as normal, certain, and permanent, except in the direction of further improvement, and any deviation from it as aberrant, scandalous, and avoidable.

If Keynes had read what he wrote, he might have been a better economist. And we might be living in a better world today.

MD: This is shades of the Red vs. Blue; The Donkeys vs. the Elephants; the Harlem Globe Trotters vs. the Washington Generals; the Keynesians vs the Mises Monks. You’re never going to solve a problem when you’re given two choices, both bad, and both controlled by a single non-choice. Such is democracy. Long live democracy.

Author:

George Ford Smith is a former mainframe and PC programmer and technology instructor, the author of eight books including a novel about a renegade Fed chairman (Flight of the Barbarous Relic), a filmmaker (Do Not Consent), and an advocate of stateless market government. He welcomes speaking engagements and can be reached at gfs543@icloud.com.

Clint Siegner is a Director at

Clint Siegner is a Director at

by Tyler DurdenSaturday, May 21, 2022 – 01:30 PM

by Tyler DurdenSaturday, May 21, 2022 – 01:30 PM

David Lawant this is my bio

David Lawant this is my bio

Clint Siegner is a Director at

Clint Siegner is a Director at  The benefit which is derived from exchanging one commodity for another, arises, in all cases, from the commodity received, not from the commodity given. When one country exchanges, in other words, when one country traffics with another, the whole of its advantage consists in the commodities imported. It benefits by the importation, and by nothing else.

The benefit which is derived from exchanging one commodity for another, arises, in all cases, from the commodity received, not from the commodity given. When one country exchanges, in other words, when one country traffics with another, the whole of its advantage consists in the commodities imported. It benefits by the importation, and by nothing else.