Rabobank: We Won’t Get Bretton Woods 3 But What We Do Get Won’t Be Peaceful Or Painless

by Tyler DurdenMonday, Apr 18, 2022 – 07:25 PM

by Tyler DurdenMonday, Apr 18, 2022 – 07:25 PM

By Michael Every of Rabobank

Bancor, Rancor, and Rancour

MD: Having a total and universal misunderstanding of what money is, we get myriad articles telling how money is being manipulated…or should be manipulated. From the title we expect this is just such an instance. We’ll look…and annotate in place.

What lies beneath

As usual, just over two weeks into the new quarter, and well in advance of the developed economies, GDP-giant China told us exactly what happened there in Q1. When I say ‘exactly’, I mean to the usual degree of decimal-place detail, but the same lack of any useful breakdown: and despite lockdowns so hard that China’s Weibo is allegedly censoring the first line of the Chinese national anthem (“Stand up! Those who refuse to be slaves”) after it was used to vent frustrations.

MD: What a bazaar opening salvo!

Somehow, the expectation was for a 0.7% q/q GDP print, 4.2% y/y, up from 4.0% in Q42021: we got a far stronger print to show Covid, and Chinese data, don’t matter – GDP rose 1.3% q/q and 4.8% y/y.

- Does one celebrate the resilience of the economy?

MD: How can one separate the economy from the manipulation of its money? - Does one ask how that was possible when March data saw retail sales -3.5% y/y, below consensus of -3.0%, down from 1.7%… and yet higher than expected at 3.3% y/y year-to-date (YTD) vs. a 6.7% print in February that already did not match what *any* retailer is seeing? When fixed asset investment, albeit above consensus, slowed to 9.3% from 12.2% y/y even as property investment was weaker than seen at just 0.7% from 3.7% y/y? And industrial production rose to 5.0% from 4.3% y/y – which must have been via net exports… despite port closures!

MD: Does anyone ask why behavior of an economy should be sensitive to a calendar? - Does one ask why monetary policy was eased last week anyway, with the reserve requirement ratio cut 0.25% again? (That’s a move which will be as ineffectual for the real economy as all the previous cuts were: the only thing it perks up is enthusiasm from analysts who don’t understand how the real economy works.)

MD: Does anyone ask why there should be such a thing as a “monetary policy”? Does anyone ask why anyone…or any small group…should have such a knob to manipulate? - Does one ask why China just announced details-free economic stimulus measures? (e.g., “Reform will be deepened to remove consumption constraints. Sound and steady development of consumption platforms will be advanced.” How so, when rumours are that we are soon to see bank deposit rates cuts to make room for lower lending rates, which follows the same financial-repression/demand-destruction path seen in the ‘new normal’ elsewhere?) Probably not.

MD: When it is provable that everyone acts in their own self interest, why does not everyone’s self interest have equal weight? Why do we have banks screwing with lending rates when we know it is “traders”, not banks or the governments they institute, that create and destroy money? - Does one ask how local-government debt to build more infrastructure is ‘consumption’? (e.g., “consumption-related infrastructure development may be funded by local government special-purpose bonds, to leverage the catalytic role of investment in expanding consumption.”)

MD: Why do we allow something claiming to be government…why do we allow it to control something like infrastructure development…but not manufacturing development? We shouldn’t even have government. What’s it good for? - Does one note an easily achievable stimulus floated is a de facto export subsidy? (e.g., “Export rebates will be better utilized as an inclusive and equitable policy tool that is consistent with international rules, and the business environment for foreign trade will be improved on multiple fronts.”) Yet if China thinks it can grow its way out of a structural crisis by flooding the world with more goods *again*, then it is in for a real shock.

MD: Do traders need stimulus? What’s keeping traders from naturally making trades they can see clear to deliver on? Why do people allow a money-changer creation like government to even exist?

Making that point, Bloomberg warns: ‘Global Investors Flee China Fearing That Risks Eclipse Rewards’. All the more reason for a 1.3 % q/q print then(?) The article notes, “Russian sanctions raise concerns the same could happen to China… a growing list of risks is turning China into a potential quagmire for global investors. The central question is what could happen in a country willing to go to great lengths to achieve its leader’s goals.” This is hardly news to those who wanted to see it: but a South China Morning Post politics podcast this weekend in which one of their correspondents stated he had heard directly from an EU source that in recent discussions over Russian sanctions, US officials stated they are already gaming-out the same measures for China – and using language such as “when we sanction China”, not “if”.

MD: Sanctions are a siege tactic. And siege is an act of war. Who is conducting this warring aggression…and why? Why does an entity capable of mounting such an attack even exist? Who needs it?

Imperialism and realism: Bancor and Rancor

Meanwhile, in Ukraine, hopes of peace talks appear forlorn: Mariupol appears close to falling, as the city of 400,000 stands in ruins; and despite talking of risks of a Russian tactical nuke, President Zelenskiy defiantly states his country won’t give up the Donbas and can keep fighting for 10 years, if needed. If supported by the West, perhaps it can – and the EU’s Von der Leyen is pushing for Europe to accelerate arms shipments to Kyiv, talking about an oil boycott, again, and sanctioning Russia’s largest bank, Sberbank. Markets were thinking 10 days and none of the above when this all started.

MD: Why doesn’t this paragraph state it was Zelenskiy whose artillery caused the ruin of Mariupol?

On another front, as Finland and Sweden race towards NATO membership, Russia is moving forces towards the Baltic. Is this a bluff, as some felt it was over Ukraine? Or is Moscow going to engage in some form of limited confrontation with either or both Scandinavian states to ensure that if they enter NATO they do so already in a conflict with Russia?

MD: Why do these countries want NATO membership? What’s in it for them? What do they lose by ostracizing NATO? What if Russia’s movements are totally defensive…or protective of the innocent…which of course they are?

Taking things to a more meta level, last week I argued ‘Bretton Woods 3’ (BW3) — a new global FX and financial architecture– is a fancy name for militarized mercantilism; that the West used to be good at it; that it will be again, even if it means lots of neoliberal norms have to go; and anyone who thinks a BW3 emerges painlessly hasn’t read any history. Usefully, one of the key proponents of ‘anti-American imperialism’ just made the point for me in depth.

MD: If you argued for any kind of “global FX and financial architecture” you are stupid beyond belief. At the very least, you are clueless about what money is…where it comes from…and where it goes. Mercantilism is government imposed monopoly. Eliminating government is the solution.

(NB For these thinkers, American imperialism is the only imperialism: everything else is ‘realism’. That was underlined by humanist and coffee-table intellectual’s intellectual —and long-time believer that the auto-genocidal Khmer Rouge get a bad press— Noam Chomsky, who explained this weekend that Ukraine should surrender, because that’s ‘just the way the world is’.)

MD: There should be a vaccine against morons like Chomsky.

In an interview, Russian politician Sergey Glazyev talks about “the imminent disintegration of the USD-based global economic system, which provided the foundation of the US global dominance… the new economic system [unites] various strata of their societies around the goal of increasing common well-being in a way that is substantially stronger than the Anglo-Saxon and European alternatives. This is the main reason why Washington will not be able to win the global hybrid war that it started. This is also the main reason why the current dollar-centric global financial system will be superseded by a new one, based on a consensus of the countries who join the new world economic order.”

MD: The fact that such a thing as “the USD-based global economic system” even exists or should be tolerated is admission of zero understanding of money. They can change the money system all they want. Until they understand what money is…where it comes from…and where it goes, they’ll keep getting the same result. And of course they want that result. This leopard doesn’t change its spots.

So far, so gold-bug, crypto-nite, Chomskyite, Russian/Chinese nationalist, US billionaire hedge-fund manager, or general Down With This Sort of Thing. But we get details:

MD: Such nonsense!

“In the first phase of the transition, these countries fall back on using their national currencies and clearing mechanisms, backed by bilateral currency swaps. At this point, price formation is still mostly driven by prices at various exchanges, denominated in dollars.”

MD: Open admission of money manipulation. A “real money process” cannot be manipulated in any fashion whatever.

That’s what I have been flagging: things remain priced in USD and, for a few, at the margin, and inefficiently, USD are netted out via bilateral, geopolitical barter. However, “This phase is almost over.” That seems ambitious: it isn’t even a month old! Regardless, next comes “a shift to national currencies and gold,” and then:

MD: A problem that does not…and cannot exist with a “real money process”.

“The second stage of the transition will involve new pricing mechanisms that do not reference the USD. Price formation in national currencies involves substantial overheads, however, it will still be more attractive than pricing in ‘un-anchored’ and treacherous currencies like USD, GBP, EUR, and JPY. The only remaining global currency candidate –CNY– won’t be taking their place due to its inconvertibility and the restricted external access to the Chinese capital markets. The use of gold as the price reference is constrained by the inconvenience of its use for payments.”

MD: A “real money process” cares nothing about pricing mechanism. That’s up to supply/demand balance of objects being traded. All the “real money process” is concerned with is guaranteeing perpetual perfect supply/demand balance of the money itself.

So, as I pointed out, nothing really works; which, alongside final consumption being in the West, and lots of aircraft carriers, is a strong argument for the USD status quo, imperialist or not. But not to worry if you disagree, because after that:

MD: When “it’s broke”, it a good time to “fix it”. You don’t fix something by changing it’s name. This will get fixed when a “real money process” is available for traders to choose. Once that is done, all these broken processes will wilt on the vine. No trader in his right mind would ever use one.

“The third and the final stage on the new economic order transition will involve a creation of a new digital payment currency founded through an international agreement based on principles of transparency, fairness, goodwill, and efficiency.” Which the international community is of course famous for. “A currency like this can be issued by a pool of currency reserves of BRICS countries, which all interested countries will be able to join.”

MD: This is like religion…constantly trying to deal with knowledge that encroaches on its myths. They just create new myths…and change the wording of the old myths. It’s pretty disgusting.

Except India is questionable, and even Brazil might be shaky given where it sits geographically, near the source of all those aircraft carriers. And so we have Russia, China, and South Africa. That doesn’t even make a good acronym, let alone bloc.

“The weight of each currency in the basket could be proportional to the GDP of each country (based on purchasing power parity, for example), its share in international trade, as well as the population and territory size of participating countries.” So, it will be dominated by China; and so India is definitely out. “In addition, the basket could contain an index of prices of main exchange-traded commodities: gold and other precious metals, key industrial metals, hydrocarbons, grains, sugar, as well as water and other natural resources. To provide backing… relevant international resource reserves can be created in due course. This new currency would be used exclusively for cross-border payments and issued to the participating countries based on a pre-defined formula. Participating countries would instead use their national currencies for credit creation, in order to finance national investments and industry, as well as for sovereign wealth reserves. Capital account cross-border flows would remain governed by national currency regulations.”

MD: If the currencies in the basket were using a “real money process”, their weight would not be relevant. The exchange rate would be constant…and one to one…at all times. This is a problem created by, and moved around by, money changers and the governments they institute. If you turn back the history of these governments you always find “one individual” who got control of a military and directed it to his own ends…and then took charge of the territory it acquired. This typically spans no more than 10 or 20 years in the first instance. And if he’s successful in creating a religion in that period, that religion passes to his heirs…until the people being dominated pull back the curtain and expose the scam. In the case of Britain, the people are so stupid it spans a period going back beyond useful records. That, folks, is perfect stupidity.

So, he is talking about a new ‘gold standard’ based on everything from precious metals to base metals, to water, to one of the key ingredients for cakes, to the GDP of China, questionable data and all. Somehow these back a new global reserve currency which somebody will manage, and provide emergency liquidity in, despite *ALMOST EVERYONE IN THE NEW BLOC RUNNING TRADE SURPLUSES* – and most so with the West, who are not going to join. As such, this is not so much a proposed Bancor, as Keynes floated at the original Bretton Woods before the US insisted on the global role of the USD; nor a monstrous Rancor to devour Wall Street; it’s just plain rancour (“bitterness or resentfulness, especially when long standing”). Indeed, here is the coup de grace:

MD: Anyone talking about a standard that changes value with time, is talking nonsense. And gold is anything but constant in value. We can now create new gold at a fraction of earlier costs…except where a new discovery is found … and then you can just pick up nuggets off the ground creating fictitious wealth. Changes like that…or large quantities going down with a sinking ship…create great disruptions. And such disruptions are totally unnecessary…actually impossible…if a “real money process” is in effect.

“Transition to the new world economic order will likely be accompanied by systematic refusal to honor obligations in USD, EUR, GBP, and JPY. In this respect, it will be no different from the example set by the countries issuing these currencies who thought it appropriate to steal foreign exchange reserves of Iraq, Iran, Venezuela, Afghanistan, and Russia to the tune of trillions of USD…. Even if they were to default on their obligations in those currencies, this would have no bearing on their credit rating in the new financial system. Nationalization of extraction industry, likewise, would not cause a disruption.”

MD: An open admission to traders that they are…and will continue to be…dictated to by the money-changers. How is it that the real producers in the world (i.e. the traders) can be so totally dominated by the absolute non-producing slugs of the world (i.e. the money changers)?

In other words, adopt the new world order and you get to default on all your FX debt and nationalise all your foreign-owned businesses! That is precisely what I also argued: bet on the new and bet on the default of the old. That is not going to be peaceful or painless – and it will be vigorously resisted.

MD: This “new world order” thing is just the new “war monger”. The latest weapons of these war mongers is immigration and virus creation and spread…and they are essentially the same thing.

You want to ensure that even vampire-squid on Wall Street and global-not-local US billionaire hedge-fund managers agree to dump neoliberalism for Western mercantilism and a bifurcated Cold War world of tariffs, capital controls, and naval blockades? Keep talking about mass nationalisations and organised debt defaults in the Eurodollar markets.52,222109

MD: These articles just continue to be less and less interesting…more and more stupidity revealing. Such is life…and then you die.

David Lawant this is my bio

David Lawant this is my bio

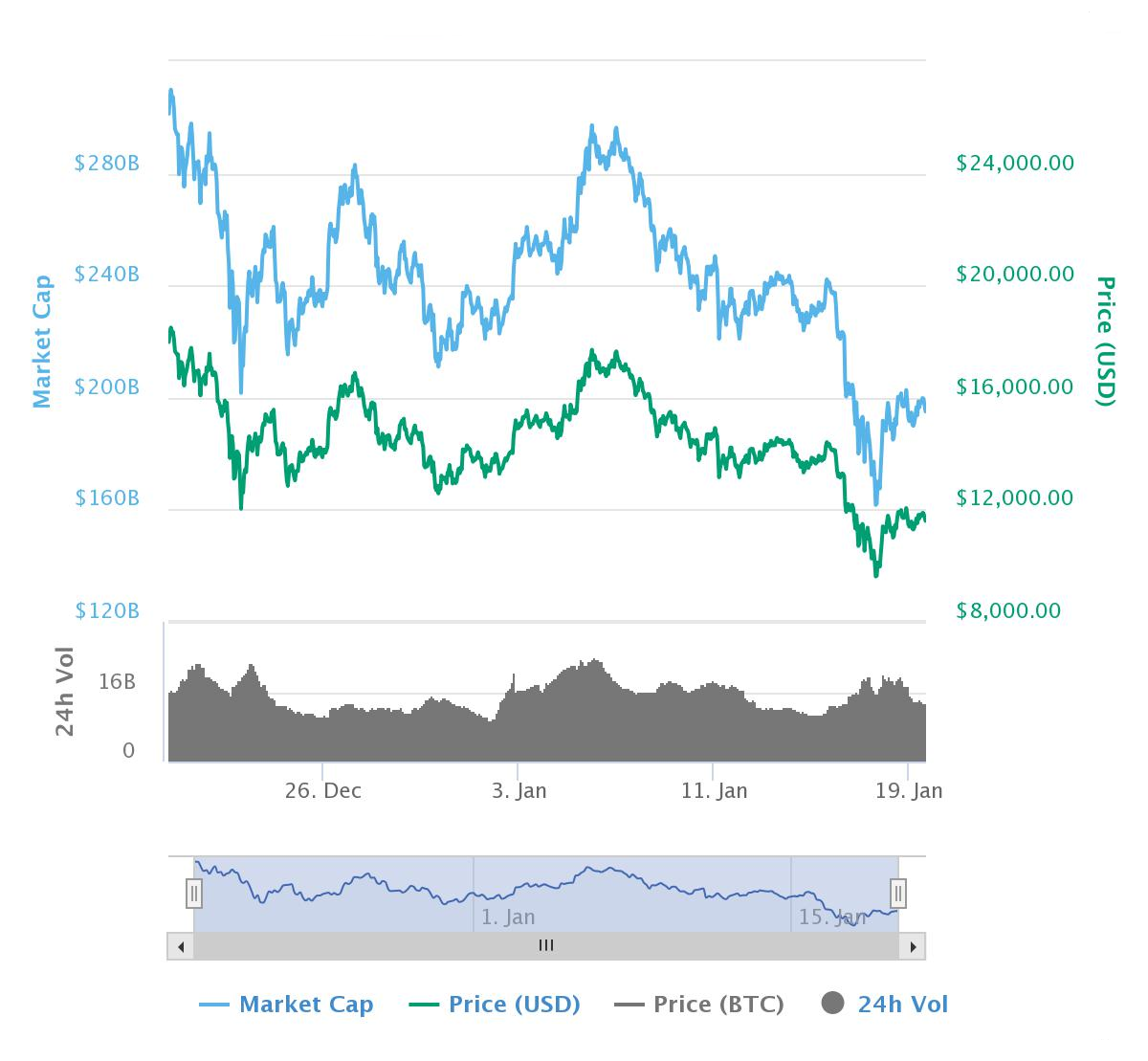

Cue much hand-wringing and gnashing of teeth in the crypto-commentariat. It’s neck-and-neck, but I think the “I-told-you-so” crowd has the edge over the “excuse-makers.”

Cue much hand-wringing and gnashing of teeth in the crypto-commentariat. It’s neck-and-neck, but I think the “I-told-you-so” crowd has the edge over the “excuse-makers.”