As Keynes noted, the paradox is that the price level and the nominal interest rate were positively correlated in the two centuries before he examined it in 1930.

MD: Well, duh! The prevailing MOE processes were instituted by the money changers. And they also instituted governments to protect their operations. Money changers require a “time value of money” for their farming operation (business cycle) and tribute demands (interest collections) to work. They use governments to collect this interest in the form of taxes. Governments sustain themselves through counterfeiting (inflation). Thus, with this process, price levels and interest rates will be positively correlated … over all time, not just the two centuries examined.

Monetary theory posits the correlation should be between changes in the level of price inflation and interest rates. Empirical evidence shows there is no such correlation. The response from the Neo-Keynesian and monetarist schools has been to ignore Gibson’s paradox instead of resolving it, so much so that few economics professors are aware of its existence today.

MD: There is only one kind of inflation … and thus no need for the modifier “price” in describing inflation. Inflation is simply the supply/demand imbalance in the exchange media itself. With “real” money (i.e. money in a “proper” MOE process), there is a guaranteed supply / demand balance and thus perpetual zero inflation.

This paper explains the paradox in sound theoretical terms, and casts doubt on the assumptions behind the quantity theory of money, with important implications for monetary policy.

MD: Money requires no theory … any more than addition and subtraction require theory. If you add and subtract improperly, you’re going to get an improper result.

INTRODUCTION

Thomas Tooke in 1844 is generally thought to be the first to observe that the price level and nominal interest rates were positively correlated. It was Keynes who christened it Gibson’s paradox after Alfred Gibson, a British economist who wrote about the correlation in 1923 in an article for Banker’s Magazine. Keynes called it a paradox in 1930, because there was no satisfactory explanation for it.

MD: The reason is obvious. Inflation comes from government counterfeiting (i.e. creating money with no intention of delivering on the promise that is the money they are creating). Defaults (and counterfeiting is just DOA (defaults on arrival)) must be mitigated immediately by interest collections of like amount. If they are not, inflation will result. So it is counterfeiting that causes interest collections. And if these are inadequate, it causes inflation as well. And that is the modus operandi of all (improper) MOE processes we have ever had.

He wrote that “the price level and the nominal interest rate were positively correlated over long periods of economic history”.1 Irving Fisher similarly had difficulties with it: “no problem in economics has been more hotly debated,”2 and even Milton Friedman was defeated: “The Gibson paradox remains an empirical phenomenon without a theoretical explanation”.3 Others also attempted to resolve it, from Knut Wicksel4 to Barsky & Summers.5

MD: But when you know what “real” money is … how it is created … how it is destroyed … and how defaults are immediately mitigated with interest collections of like amount … and if not, inflation results … well, there is “no” paradox at all. The behavior observed is the behavior expected. How can these so-called great economists be so clueless?

Monetary theory would suggest the correlation should have been between changes in the level of price inflation and interest rates. This is the basis upon which central banks determine monetary policy, and now that the gold standard no longer exists, it is probably assumed by those that have looked at the paradox that it is no longer relevant. This appears to be a reasonable explanation for today’s lack of interest in the subject, with many professional economists unaware of it.

MD: With a proper MOE process, there is no such thing as “monetary policy”. The proper MOE process is totally objective and immune to any attempt to influence it with policy. The gold standard never did exist. There was never enough gold for it to exist. It has always been a purposeful illusion … created by those who had the gold.

Those economists who have examined the paradox generally agree that it existed. This paper will not go over their old ground other than to make a few pertinent observations:

• Data over the period covered, other than prices for British Government Consols cannot be deemed wholly reliable for two

reasons. Firstly, price data from 1730 to 1930, the period observed, cannot be rigorous; and secondly any observations of price levels by their nature must be selective and subjective as to their composition.

MD: For price data to be useful, it must be in units that don’t change over time or space. Ounces of gold is not such a unit. A HUL (Hour of Unskilled Labor) is such a unit. It has always traded for the same size hole in the ground. So if prices (which are typically related to ounces of gold) would be translated to HULs at that point in time, the gold measurement distortion could be removed. The way to do this is to first determine the ounce of gold per HUL rate at each point in time.

• Attempts to construct a theory to explain the paradox after the Second World War differ from earlier attempts, because the more recent academic consensus dismisses Say’s Law, otherwise known as the law of the markets. Barsky & Summers in particular resort to mathematical explanations as part of their paper, thereby treating it as a problem of natural science and not a social science.

MD: “According to Say’s Law, when an individual produces a product or service, he or she gets paid for that work, and is then able to use that pay to demand other goods and services.” But what does he get paid with? He gets paid with money. And money is “an in-process promise to complete a trade over time and space”. So Say’s Law has no relevance.

• The economists who have tackled the problem were unaware of the Austrian School’s price and time-preference theories, or have dismissed them in favour of Neo-Keynesian and monetary economics. The silence of the Austrian School on the subject is an apparent anomaly.

MD: The Austrian School is totally clueless about money … what money is, always has been, and always will be. With “real” money, it is proven that its “time-value” is zero. Therefore, any “time-preference theories” are out the window. They only exist with non-zero (and particularly with positive) inflation. With “real” money, inflation is guaranteed to be perpetually zero.

The Author shows that the theoretical reasoning of the Austrian School leads to a satisfactory resolution of the paradox without having recourse to questionable statistics or mathematical method.

MD: If it does that, it does it totally by accident … or by being a paradox itself. Let’s see.

THE PARADOX

Gibson’s paradox is based on the long-run empirical evidence between 1730 and 1930, a period of 200 years, when it was observed by Arthur Gibson that changes in the level of the yield on British Government Consols 2 ½% Stock positively correlated with the wholesale price level. No satisfactory theoretical explanation for this correlation has yet been published. It is shown in Chart 1 (Note: annual price data estimates from the Office for National Statistics are only available from 1750).

MD: Where’s the mystery? The stock level is a function of inflation of the money itself. The general price of all objects is a function of inflation. They will always correlate. With a proper MOE process, that correlation curve will be a straight horizontal line.

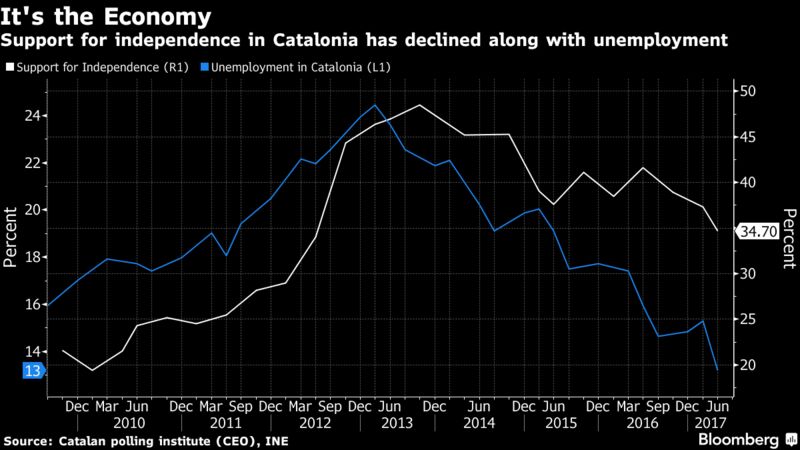

The quantity theory of money suggests that instead there should be a strong correlation between changes in interest rates and the rate of price inflation. However there is no discernible correlation between the two. Contrast Chart 2 below with Chart 1 above.

MD: That failure to correlate is because of the failure to bring “defaults” into the analysis. If interest collections equal defaults there will be no inflation. To the extent they don’t (i.e. to the extent government counterfeiting is experienced and tolerated) there will be inflation. In a proper MOE process, interest collections are perpetually exactly equal to defaults experienced and inflation is perpetually equal to zero. They are trying to correlate the wrong two values.

If Gibson’s paradox is still relevant it presents a potential challenge to monetary policy. The question arises as to whether it is solely an empirical phenomenon of metallic, or sound money, or whether its validity persists to this day, hidden from us by the expansion of fiat currency and bank credit, and the central banks’ success in substituting pure fiat currency in place of sound money. If the paradox is solely a consequence of metallic, or sound money, it might pose no threat to the modern currency system; otherwise it may have profound implications.

MD: Monetary policy is an oxymoron when you know what real money is and the “proper” MOE process that delivers it. There is no such thing as “sound” money. This is now they refer to gold used as money. But gold represents a trade completed. It has never represented a trade in process and thus has never been money. The fact that they use it as an intermediary object does not make it money.

Modern macroeconomists appear ill-equipped to tackle this issue. The paradox is essentially a market phenomenon and macroeconomics is at odds with markets.

MD: If you’re describing issues that are a function of money and you are clueless about all things regarding money, you’re going to be “ill-equipped”.

An economist who favours macroeconomic theory will acknowledge a primary function of the state is to intervene in markets for a better outcome than a policy of laissez-faire; and that the needs and wants, the purposeful actions of ordinary people, collectively through markets free of exogenous factors, can be improved by government intervention.

MD: A person with two brain cells will recognize that the function of the state is to protect the money changers who instituted it in the first place … for that explicit purpose with the additional purpose of being the collector of the tribute they demand (i.e. taxes which are delivered to the money changers as interest payments).

Yet it is ordinary people and their businesses that were behind the relationship between the interest rate on gold or gold substitutes and wholesale prices during the period the paradox was observed.

MD: This is absolute nonsense. Ordinary people (i.e. traders) invented money. The money changers then co-opted that invention and took control in their own interests. There is no paradox here. There is only corruption. If traders institute a “proper” MOE process to compete with the money changer co-option … poof! The money changers and the governments they institute are out of business. They can’t compete. They can only tie … and they’re not interested in a draw.

For this reason an approach to the problem that is consistent with Say’s law and denies the validity of conventional neo-classical economic theory is more likely to resolve the paradox.

MD: Any economic theory is based on a false premise. When you have a proper premise no theory is called for. What is the theory of addition and subtraction?

WHY SAY’S LAW IS IMPORTANT

Say’s law describes the fundamental framework within which markets work. By implication it holds that each one of us produces a good or service so that we can buy the goods and services we want: 6 we produce to consume so we are both producers and consumers.

MD: Well duh! Is Say the inventor of “trade”. I think not!

Put another way, we cannot acquire the wide range of things we need or want without providing our labour and specialist skills for profit, the profit we require to sustain ourselves.

MD: That is not true. We trade our time, energy, skills, and/or resources for objects (produced by others time, energy, skills, and/or resources). We only profit when we use money to do this and end up with more money than we originally bargained for. If we end up with less money than we bargained for, we must add time, energy, skills, and/or resources to deliver on our original promise that created the money in the first place.

Furthermore, we may choose to defer some of this consumption for future use when it is surplus to our immediate needs. Deferred consumption is saving, the accumulation of wealth, which is either redeployed by the individual to maximise his own productive capacity, or made available to other individuals to enhance their skills for a return. The medium that facilitates all these activities is money, which effectively represents stored labour. It stands to reason that the money used has to be acceptable to all parties.

MD: It is just incredible how they can confuse and distort the obvious!

The primary purpose of money as a transaction medium is to enable all goods and services to be priced, thereby removing the inefficiencies of bartering.

MD: This is “absolutely” wrong. The “only” purpose of money is “to enable simple barter exchange over time and space.” It is created by traders making promises and getting them certified … that certificate record being money. It is destroyed by traders delivering on their promises and destroying the money (cancelling the record) they created. For any given trading promise, no money exists before the promise nor after delivery. Any trades “using” money (as contrasted with those “creating” money) view the money as the most common object in simple barter exchange.

Money enables a buyer to compare the cost and benefits of one item against another, and for producers to compete and provide what consumers most want.

MD: Not if that money allows open counterfeiting by government. In that case, the trader must estimate the inflation that that counterfeiting causes. And not if money is measured by ounces of gold. In that case, the trader must estimate the supply/demand imbalance in gold itself. An “improper” MOE process makes a trader’s job significantly more difficult … and opens the door for money changer encroachment, manipulation, and tribute demands.

The forum for this competition is the market, a term for an intangible entity, which facilitates the exchange of goods and services between producers and consumers.

MD: Correct. But money is immune to that competition if it is “real” money from a proper MOE process. This is because such a process guarantees perpetual perfect supply/demand balance for the money itself. The money itself is in perpetual free supply (created by responsible traders at will as needed to effect trading promises over time and space).

Consumers decide how they wish to allocate the fruits of their labour, and it is up to producers to anticipate and respond to these decisions. If someone is not productive and has no savings in order to consume and survive, he or she will require a subsidy, such as welfare or charity, provided from the surplus of other producers. Despite the flexibility money provides these human actions, they cannot be separated.

MD: Wrong. Someone can make a trading promise with no savings at all … and most do. Ideally, all trades would be such. Savings is an inventory control tool … it is safety stock necessary to mitigate uncertainty.

Therefore everyone is both a producer and consumer, or if unemployed, indirectly so. And it is the individual decision of the consumer what proportion of his production profit to put aside, or save for the future.

MD: Again … that is an inventory control concept.

Say’s law describes economic reality, and was generally recognised as the fundamental law of economics until about 1930. But it was an inconvenient truth for some thinkers in the late nineteenth century, most notably for Karl Marx, who advocated state ownership of the means of production, and the national socialists of the early twentieth century who advocated state control of production through regulation.

MD: Why would traders want the state involved at all when the state is obviously instituted by the money changers and is sustained totally by counterfeiting (which enables the money changers fiction of the “time value of money” … and creates the inflation that delivers that illusion … or more properly, delusion).

Both socialism and fascism were attempts by the state to subvert the free market process that allowed producers to have the freedom to respond to consumer demands, so both creeds contravened Say’s law. Finally, Keynes began in the 1930s to work up a proposition to separate production from consumption and to dismantle the relationship between current and deferred consumption, which culminated in his General Theory, published in 1936.6

MD: Keynes did nothing that wasn’t already being done. He just started twisting the money changer’s inflation knobs more drastically. More uncertainty (though it isn’t uncertain to the money changers at all … they’re driving the bus) serves the money changers farming operation … they call it the business cycle.

Keynes’s influence on modern economics is fundamental to today’s macroeconomic theories and has led to a widespread academic denial of Say’s law. Modern academics, including Keynes himself, were therefore unsympathetic with the theoretical framework required to address the paradox, if only on the basis that it was commonly accepted over the period being considered. It is also an anomaly that the subject seems to have escaped the attention of London-based economists of the Austrian School, such as Robbins and Hayek for whom Say’s law remained a fundamental basis of economic theory.

MD: What we have here is a failure to think. In this case “all” economists are provably and laughably wrong beyond belief. And the proof that they are wrong is simple beyond their wildest comprehension.

THE FINANCIAL AND ECONOMIC BACKGROUND TO 1730-1930

Gibson’s paradox was recorded in Britain, so we must first examine the social and economic conditions that pertained in order to understand the circumstances behind the paradox, and to eliminate the possibility it was the result of circumstances rather than evidence of sound theory yet to be explained.

The increase in the above-ground stock of gold, which was the foundation of money and all money substitutes for much of the time, was a potential factor over the period observed.

MD: So they’re using ounces of gold and what it trades for as their measuring stick. They’re using a rubber ruler. Is it any surprise they get spurious readings?

Uses for gold included jewellery and other adornments as well as money mostly in the form of coin, so it is not possible to establish accurately the money quantity.

MD: Which was its fallacy. Money, to be “real” needs it to be in perfectly free, unrestrained supply. Use of gold obviously constrained trade when it was confused with (i.e. used as an inefficient and ineffective substitute for) real money.

The observation was of British prices and bond yields, so it is the quantity of gold in circulation as money in Britain which matters, though there is the secondary consideration of gold in circulation in the hands of Britain’s trading partners.

MD: Make an incorrect rule and have an incorrect perception or premise, and you’re going to get an incorrect result. Gold is not money. Never has been. Never will be.

During the whole period with the exception of the 8 disruption caused by the Napoleonic wars, the quantity of gold was regulated between Britain and her trading partners solely by the demands of trade.

MD: Oh really? How about when the Spanish plundered the Aztecs? How about when new discoveries were made in California and Alaska? How about when a ship carrying a large amout of gold went to the bottom of the ocean and could not be recovered? The only way you can use gold as money is by edict … and that’s what is being explained and justified here.

Given the low level of peacetime intervention by governments in free markets at that time, differences in prices between countries were arbitraged through gold movements.

MD: It’s not a low level of “intervention”. It is a “higher” amount of counterfeiting by government in times of war. That’s why the money changers call for (and manipulate the people into) a war in the first place. The people have nothing against the people they are forced to fight.

We can therefore reasonably take the global quantity of aboveground gold stocks as indicative of the quantity of money in circulation regulated only by the market’s requirements; though bank credit or the over-issue of unbacked money became an increasing cyclical factor following the Bank Charter Act of 1844.

MD: And that is “reasonably” stupid. Stupid is as stupid does. Bank credit is a hoax brought to you by the money changers. Only traders create money … and only traders (well traders and counterfeiting governments) ever have created money.

Prior to the Napoleonic Wars, Britain began to build herself into the most powerful trading economy in history, aided by her overseas possessions and influence, together with the declining influence of Spain after the War of the Spanish Succession.

MD: Actually, it was aided by their “force”. They called it mercantilism. They just used force to limit trade to their companies. That’s why they had to have such a big and powerful navy.

The development of trade with India in the eighteenth century will have increased British demand for gold.

MD: Why? This is nonsense. It increased their demand for force. What did the Indians care about gold?

The wars against France following the French Revolution were costly both socially, involving nearly half a million men in the army and navy, and financially leading to a drain on gold reserves. Prices rose, driven by the increase in unbacked money substitutes issued by the country banks, and by the diversion of financial resources to support the war effort.

MD: Oh my! How self delusional can these writers be? When you have a false premise, you going to make false statements.

This led to the suspension of specie payments on demand against bank notes in 1797. By that time the public had become used to accepting bank notes as a valid substitute for gold, so it continued to accept them in lieu of specie.

MD: Well duh? Do you not know how the money changers farming operation works?

Following the Napoleonic wars, the economy had to adjust to peacetime. The Bullion Committee, which had been formed in 1810, recommended a resumption of specie payments to address the problem of rising prices, a recommendation rejected by the government.

MD: Right. And today we have LIBOR.

It was not until 1819, when the war had been over for four years that a second committee under the chairmanship of Robert Peel again recommended a return to specie payments, and from 1821 onwards a gradual resumption of cash payments for banknotes resumed.

MD: The money changers farming operation is maintained by jerking traders around … and front running the disruptions.

The over-issue of notes by the banks during the Napoleonic wars led to the failure of eighty country banks in 1825.

MD: And what is a bank failure? Its the bank “stiffing” the depositors. Failure is in the eyes of the beholder.

This was followed by two Acts of Parliament: in 1826 restricting the Bank of England’s monopoly to a radius sixty-five miles from London but permitting it to compete with branches in the provincial towns; and in 1833 withdrawing the Bank of England’s monopoly altogether. Banks were then free as a consequence to expand from single-office operations into branch networks through a process of expansion and mergers. The foundation of today’s British banks dates from this time.

MD: With a proper MOE process, no manipulation of any kind is possible.

During this period the debate about the future of money and banking intensified, with the banking school arguing that banks should be free to issue notes as they saw fit, so long as they were prepared to meet all demands for encashment into specie.

MD: But how were banks to put those notes into circulation as money? Answer: Traders (like you and me) put them into circulation. It has always been traders who create the money and put it into circulation. The bankers have just co-opted the process.

The currency school argued instead for bank note issues to be tied strictly to specie held in reserves. The controversy between these two schools ended with the Bank Charter Act of 1844, which required the Bank of England to back its note issue with gold, with the exception of £14,000,000 of unbacked notes already in circulation. The intention was for Bank of England notes to gradually replace those issued by other banks in England and Wales (Scottish banks still issue their own notes to this day).

MD: This is all again just manipulation by the money changers. They will accumulate gold and then dictate that it is money. When traders assimilate, they will say gold is not money and begin to counterfeit. And they will just continue the cycle.

Thus it was that the Bank Charter Act of 1844 sided with the currency school, so far as the note issue was concerned; but by neglecting the issuance of credit, modern fractional reserve banking was born.

MD: What does a charter mean when it is granted by a government to money changers … the very money changers who instituted the government to give them their monopoly and protect them from encroachment? If there was a “proper” MOE process producing “real” money, they couldn’t compete. Their monopoly would go totally unused.

It can be seen that Gibson’s paradox had to survive substantial variations of economic and monetary conditions likely to disrupt any correlation between the level of wholesale prices and interest rates.

MD: Nothing like adding irrelevant variables and noise to complicate an analysis and make prediction impossible.

If there was a common factor over the two centuries, it was that the domestic UK economy expanded rapidly, facilitated initially by a developing network of canals, which in addition to river and sea navigation enabled the transport of goods throughout the country for the first time.

MD: And such expansion would have zero impact on a “proper” MOE process. This is because money creation by responsible traders (those who don’t default) is totally unrestricted.

As the industrial revolution progressed, the new science of thermodynamics led to the development of steam power, fuelled by coal which was found and mined in abundance. The mechanisation of factories and mills together with the subsequent development of railways rapidly increased both productivity and the speed of transport and communications.

MD: And again, none of that would have been affected nor would have had an effect on “real” money. It is immune to such changes.

Her position as an important global power gave Britain access to raw materials and overseas markets to fuel economic and technological progress. Britain was so successful that before the First World War eighty per cent of all shipping afloat at that time had been built in Britain. d

MD: And that wasn’t by accident. Britain has always been a bad world citizen. They have always used force to beat down their competitors. And they have always leveraged that force by getting their competitors to fight among themselves … divide and conquer.

Finally, in the post-war decade to 1930 Britain underwent massive social and political changes, which were generally destructive to the accumulated wealth of the previous century.

MD: Wrong. They just transferred the influence to their colony … the USA. Britain never gave up colonial control of the USA.

GOLD SUPPLY

Without an increase in the quantities of gold available the expansion of economic activity brought about by the industrial revolution would have been expected to lead to a trend of falling prices.

MD: In other words, gold is “deflationary”. There is never enough of it so it becomes more dear when traders, by edict, must use it as money to effect their trading promises over time and space.

As it was, new mines were discovered, notably in California, the Klondike, South and West Africa, and Australia. By 1730 the estimated aboveground stocks accumulated through history were about 2,400 tonnes, and by 1930 they had increased to 33,000 tonnes.7 Britain’s population increased from roughly seven million to forty-five million. In other words, the quantity of gold available for money increased at roughly double the rate of the British population over the two centuries.

MD: By that data, the supply of gold would have roughly exceeded the demand for gold by double … so prices should have gone up. The price of gold should have gone down. Regardless, this just shows why you can’t use a commodity for money. It just unnecessarily complicates trades over time and space. And if the trades were being measured in units of HULs, there would be no confusion.

Other things being equal, the net monetary effect from the increase in the quantity of above-ground gold stocks can be expected to reduce its purchasing power relative to goods; but it is an historical fact that the rapid industrialisation over the period raised the standard of living and life expectancy for the average person considerably, thereby offsetting the inflationary price effects of increased above-ground stocks, so much so that prices appear to have fallen by 20% between 1820 and 1900 according to the ONS figures used in Chart 1.

MD: Again, none of that cause and effect would have bothered a “proper” MOE process at all. Injecting a commodity into the mix (and a specific commodity at that) just complicates things … unnecessarily.

THE QUANTITY THEORY OF MONEY

MD: We will know this topic to be total nonsense without even reading it. We know that with “real” money the supply is perpetually exactly equal to the demand.

The quantity theory as it is generally understood today dates back to David Ricardo, who ignored the transient effects of changes in the 11 quantity of money on prices in favour of a long-run equilibrium outcome.

MD: In electronic control systems we call this “low pass filtering”. We deal with averages and thus can ignore the noise. And it doesn’t work in electronic control systems either, if the noise and the signal appear indistinguishable.

In 1809 Ricardo took the position that the reason for the increase in prices at that time was due to the Bank of England’s over-issue of notes. His interest in this respect glossed over the short-run distortions identified by Cantillon and Hume. In the Ricardian version an increase in the quantity of money would simply result in a corresponding rise in prices.

MD: The issuance of a note is the documentation of a trader making a delivery promise that spans time and space. If note issuances increased, it meant traders increased or trading promises increased or both. If trading promises were delivered, there is no issue.

While this relationship is intuitive, it makes the mistake of dividing money from commodities and putting it into a separate category.

MD: What is that supposed to mean?

An alternative view, consistent with the theories of the Austrian School, is to regard money as a commodity whose special purpose is to act as a fungible medium of exchange, retaining value between exchanges.

MD: But it can only do that by maintaining perfect supply/demand balance of the exchange media itself… and no commodity can do that. The Austrian’s theory precludes them from using any commodity as the exchange media. And they just don’t get that!

This being the case, it must be questioned whether or not it is right to put money on one side of an equation and the price level on the other.

MD: But they’re using a “unit” of measure which is actually two units of measure combined. One unit is the “ounce”. The other unit is the “value” (i.e. supply/demand balance) of gold. That variable gold balance is the problem.

This is not to deny that a change in the quantity of money for a given quantity of goods affects prices.

MD: It should. Quantity of money doesn’t affect prices if its balance against demand for money remains constant.

That it is likely to do so is consistent with the relationship between the relative quantities of any exchangeable commodities.

MD: Supplies of exchangeable commodities are never in constant balance with the demand for those commodities … especially if those commodities are declared to be money.

Furthermore, there is an issue of preferences changing between the relative ownership of one commodity compared with another; in this case between an indexed basket of goods and money.

MD: All the more reason to reject commodities for use as money.

Changes in the general level of cash liquidity can have a disproportionate effect on prices, irrespective of changes in the quantity of money in issue at the time.

MD: With a “proper” MOE process and “real” money, cash is always perfectly liquid. Prices don’t change due to this characteristic of real money because all the money created is later destroyed by a like amount. It’s a zero sum game over time.

By ignoring these considerations it is possible to conclude that changes in the quantity of money in circulation are sufficient to control the price level.

MD: But you don’t want to “control the price level”.

It is this assumption that Gibson’s paradox challenges. To modern macroeconomists the price of money is its rate of interest, though to followers of the Austrian school, this is a gross error.

MD: It is a gross error. But Austrian school followers are in error too … in the opposite direction.

To them, the price of money is not the rate of interest, but the reciprocal of the price of a good bought or sold with it.

MD: It doesn’t get much stupider than that. With “real” money, there is no “price of money”. What’s the “price” of a HUL? It’s just a unit … an unvarying unit of measure.

Furthermore, under this logic money has several prices for each good or service, which will differ between different buyers and sellers depending on all the circumstances specific to a transaction.

MD: That’s like saying an ounce of carrots is different than an ounce of beef. It’s like saying the value of one is different than the value of the other. So what?

This is consistent with the Austrian school’s observation that prices are 12 entirely subjective and they cannot be determined by formula.

MD: Correct. But what the Austrian school fails to say is that the units used to measure those value differences must be constant over all time and space … and an ounce of gold does not come close to meeting that requirement.

Macroeconomics does not recognise this approach, and averages prices to arrive at an indexed price level. Austrian school economists argue that mathematical methods are wholly inappropriate applied to the real world. Apples cannot be averaged with gin, nor can gin be averaged even with another brand of gin. Averaging the money-values of different products cannot escape this reality.

MD: And “real” money has no interest in prices whatever. They are strictly a perception of the traders for specific trades.

The rate of interest on money is its time-preference; and again, depending on what the money is intended to be exchanged for its time-preference must match inversely that of the individual good.

MD: And this is provably wrong. Presuming the divisor is the amount of money created and the numerator is the amount of money taken to mitigate defaults ( interest collected), this has nothing to do with “time-preference” at all. If there are no defaults, a non-zero interest collection is just wrong regardless of the time span … and not allowed in a proper MOE process.

In other words, by deferring the delivery of a good and paying for it up-front it should be possible to acquire it at a discount.

MD: Why? If I supply you food, shelter, and other stuff while you build a house for me, is one of us entitled to a discount while the other is not when it comes to this trade? Of course not!

There is the possession of the money foregone, the uncertainty of the contract being fulfilled and the scarcity of the good, which all combine into a time-preference for a particular deferred transaction.

MD: Correct. But that is not the concern of the MOE process. If the MOE process detects a default, it immediately meets it with an interest collection of like amount. If it collected interest in anticipation of a larger default, it must return the difference … and vice versa. It works just like casualty insurance where PREMIUMS = CLAIMS in aggregate.

The quantity theory of money ignores this temporal element in the exchange of money for goods.

MD: And properly so with a proper MOE process where inflation of the money itself is guaranteed to be perpetually zero.

In doing so, it fails to account for the fact that in free markets demand for money, reflected in its time-preference, must correlate with demand for goods.

MD: And it does. A trader is making a trade spanning time and space. He must recover all the money he creates in delivering on that trade.

The quantity theory, by putting money on one side of an equation and goods on another suggests the relationship is otherwise. This gives us an insight into why the quantity theory of money is flawed, and when we explore the Gibsonian relationship between interest rates and the price level it will become obvious why interest rates do not correlate with the rate of price inflation.

MD: It may explain why quantity theory is flawed. Let’s see if an unflawed theory is revealed. We know the flawless process … and it’s not theoretical at all. It’s just outright obvious!

THE SOLUTION TO GIBSON’S PARADOX

In the discussion covering the flaws in the quantity theory of money in the previous section clues were given as to how the paradox might be resolved. The starting point is to recognise that money is simply a commodity, albeit with a special function, to act as the temporary store of labour between production and consumption.

MD: If you recognize money is a commodity, you are provably wrong right out of the box. Money “must” maintain perpetual perfect balance between supply and demand for the money itself … and obviously no commodity can do that. And you can make no argument for relaxing or removing this constraint. Here’s an example where the incorrect premise is revealed immediately so no further pursuit along these lines is valid. It’s not about “temporarily storing labor”. It’s about keeping score and maintain perpetual perfect balance … by detecting defaults as they occur and immediately mitigating them with equaling interest collections.

We can see that including money, commodities necessary for human progress were in demand during a period of unprecedented economic expansion over the two centuries between 1730 and 1930.

MD: There are very few commodities necessary for human progress. Water and protein … that’s pretty much it. They are not money.

In some cases, such as in exchange for harvested grains, the price of gold would have varied from season to season, often wildly.

MD: Which precludes it from being money.

But with all the individual goods, there will have been a match with their time-preferences between manufactured goods and gold and gold substitutes.

MD: Nonsense! Prove it!

Therefore, the interest rate on money offered by banks is the other side of the time-preferences of the goods produced by their borrowers, who were predominantly manufacturers and merchants seeking trade finance.

MD: Banks don’t “offer interest rates”. They “demand tribute”. With a proper MOE process, banks don’t exist at all. What in the world would they do with inflation of the money itself guaranteed to be perpetually zero.

The reason interest rates are set by the demands for money by manufacturers is they have to expend capital in order to produce. Capital becomes one of two essential elements of the price of a future good, the other essential being profit. The capital value of an asset used in production is the sum of the value of output it generates discounted to its present value.

MD: Capital is just another figment of a capitalist’s (i.e. money changer’s) imagination. A HUL delivering a hole by just scraping with flat rocks will deliver a smaller hole than one delivering a hole with the use of a shovel. But the capital cost of that shovel is huge for just a one HUL hole. And it’s minuscule for 1,000 HULs of holes.

But when you put the concept of capital in the money changers’ hands … well, it’s simply “two years”. Making a 4% spread, a money changer with a 10x leverage privilege will double his so-called capital in two years, will pull it off the table, and have no skin in the game from thereafterv … yet his so-called capital will continue to “work?” in the marketplace.

If prices of goods are rising, the producer can increase his time-preference in the expectation of higher end-prices for his production. Alternatively, if prices are not rising, or even falling he is limited in his time-preference.

MD: If prices of “all” goods are rising, you have a money problem. That doesn’t happen with “real” money.

This explains why when prices generally rose, bond yields, as proxy for term interest rates paid by borrowers, also rose.

MD: Here’s an alternate explanation. The money changers had already co-opted the traders money process. Traders seeing prices rise saw an opportunity to supply what was rising in prices. They made trading promises spanning time and space to do that … i.e. they created money. The money changers, controlling their ability to create money, charged higher and higher interest (they were opportunist). Conversely, if prices were falling, traders didn’t want to make time spanning trading promises. They hunkered down and the money changers had no opportunity. They couldn’t collect tribute for something traders didn’t want … i.e. money. But you see you get different results. when what is going on is vastly different than what “should be going on … i.e. proper MOE process”.

Equally, when prices fell, a producer was less able to bid up his time preferences, so term interest rates fell. In other words, before central banks took upon themselves to control interest rates, interest rates simply correlated to demand for capital from producers.

MD: When you artificially put yourself in the supply chain … as bankers do … you can extract tribute … if that chain is active.

This analysis of the relationship between prices is wholly in accordance with Carl Menger’s insight, that a price only exists for commodities and goods for which supply is limited to less than potential demand.8

MD: A price exists regardless of supply/demand balance for the object being traded. A price of “1.000” exists in units of HULs for all money used to effect those trades over time and space. Menger is the blind leading the blind.

POST-1930

After 1930 the paradox was still observed until the 1970s, when the relationship appeared to break down.

In the 1970s price inflation according to the ONS accelerated from 5.4% in 1969, to 17.1% in 1974.

MD: Again, there’s only one kind of inflation … supply/demand imbalance for money itself. It only arises out of an “improper” MOE process. If inflation tripled in that period, it is because counterfeiting and defaults as related to interest collections tripled in that same period.

During that time the Bank of England only increased interest rates under pressure from the markets.

MD: i.e. their interest collections were less than defaults (mostly in the form of government counterfeiting) resulting in inflation by the relation: INFLATION = DEFAULT – INTEREST in aggregate terms. Use whatever denominator suits you if you want it in terms of rates.

Interest rate policy fed a growing preference for hoarding goods and reducing personal cash balances. In this case, the correlation between bond yields and the price level reflected a shift in public confidence in the future purchasing power of the currency, which drove the time-preferences in the market, instead of widespread demand for capital investment.

MD: And there’s the fallacy. They think interest collections come out of policy. That puts them either behind or ahead of the game … and perpetually wrong.

Bond yields topped out in autumn 1974 before declining; but interest rates finally peaked in 1979/80. This is not fully reflected in the bond yield shown in Chart 4, because the yield curve was sharply negative at that time.

MD: How do you expect to analyze what’s going on when you have manipulators turning knobs like little kids turning steering wheels on a carnival car ride that’s taking them around in a circle.

Since that tumultuous decade correlation ceased, and the Bank of England appears to have gained control over interest rates from markets.

It is hardly surprising that when central banks implement monetary policies to ensure that the price level never falls, the normal relationship between the price level and interest rates is interrupted. The relationship between savers and investing producers, which is the basis of the Gibson observation, becomes impaired.

MD: Conclusion: Don’t let anyone “implement monetary policy”.

CONCLUSION

The following question was raised earlier in this paper:

If Gibson’s paradox is still relevant it presents a potential challenge to monetary policy.

MD: Monetary policy is an oxymoron and should be challenged everywhere it raises its ugly manipulatory head.

The question arises as to whether it is solely an empirical phenomenon of metallic, or sound money, or whether its validity persists to this day, hidden from us by the expansion of fiat currency and bank credit, and the central banks’ success in substituting pure fiat currency in place of sound money.

MD: If metallic money is sound money, then they have corrupted the meaning of “sound”. Metallic money can never be “real” money … and real money always easily out compete metallic money. Well, that’s not exactly true. In 1964 we had metallic coins with 90% silver. In 1965 we had metallic coins with 0% silver. In both years those coins traded for the same amount of “stuff”. Thus, the silver (intrinsic value) played no role in the trades at all.

If the Paradox is solely a consequence of metallic or sound money it might pose no threat to the modern currency system; otherwise it may have profound implications.

It is clear that the difference between markets historically and those of today is that interest rates were set by the demand for savings to invest in production, while today they are set by monetary policy.

MD: Evidence they were not determined by defaults experienced and thus they were improperly set in both instances … and achieving predictably different but improper results.

Monetary policy is not consistent with the basic function of interest rates, which is to reflect a market rate between savers and borrowers to balance supply and demand. Instead, monetarists believe otherwise, that interest rates can be used to regulate the quantity of money.

MD: Interest collections is not a policy variable. In a proper MOE process, they perpetually equal defaults experienced … just like in insurance PERMIUMS perpetually equal CLAIMS.

Gibson’s paradox is not dependent on metallic or sound money so much as it is dependent on free markets distributing savings in accordance with demand from borrowers investing in their businesses. We must therefore conclude that monetary policies intended to suppress this effect do have profound implications.

MD: A proper MOE process cares noting about savings. They have no effect on the process at all. Further, it doesn’t use the term “borrowing” or “loan” or “borrower”. It is “always” traders “creating” money which represents their in-process promise to complete a trade over time and space”… period!

Keynes in his General Theory in 1936 wrote the following in his concluding notes:

“I see, therefore, the rentier aspect of capitalism as a transitional phase which will disappear when it has done its work. And with the disappearance of its rentier aspect much else in it besides will suffer a sea-change. It will be, moreover, a great advantage of the order of events I am advocating, that the euthanasia of the rentier, of the functionless investor, will be nothing sudden, merely a gradual but prolonged continuance of what we have seen recently in Great Britain, and will need no revolution.”9

MD: Taking that unreadable paragraph and making some sense of it is pretty tough. But have you noticed that this article, and that paragraph, make no mention of the trader … the trader which is always the principal player … the trader without which the rentier or the functionless investor can do nothing at all?

The long, slow euthanasia of Keynes’s rentier class is what has changed. Businesses obtain the funds for investment from other sources directed by the financial system.

MD: That’s a flaw in the thinking. Investors (and funds from them) are only needed by deadbeats (those who can’t create money because they are not responsible traders) in a process of “real” money. Deadbeats are the exception … not the rule. That is, unless you are talking about governments … then they are the rule, not the exception.

Savers are channelled increasingly into stock markets, where they participate in businesses as co-owners, instead of lending to them indirectly through the banking system. The banks provide working capital, mainly through the expansion of bank credit, at rates primarily determined not by supply and demand for savings, but set by central banks.

MD: Businesses have a risk. The “individuals” running the business may create money … but they risk their responsible trader status if they fail. So they may choose to spread that risk among other traders. It’s a choice. With a “proper” MOE process, only real trading “persons” can create money. Businesses can’t do it. So when operating as a business they must resort to stocks or bonds to meet their trading needs over time and space. In so doing, they are using “existing” money created by traders with a persona.

Central banks’ insistence on monetary solutions to economic problems have not only buried the Say’s law relationship between savers and investing entrepreneurs, they have turned the principal objective of entrepreneurs from patient wealth creation through the accumulation of profits into ephemeral wealth creation through the accumulation of debt.

MD: So recognize central banks for what they are: the creation of money changers … who are the institutors of governments … who are the keepers of the central banks … who protect the money changers farming operation and demands for tribute. It’s just that simple to dissect folks! It’s a scam!

They have been caught up in a credit cycle created by central banks and are no longer borrowing genuine savings from savers who expect to be repaid. If Gibson’s paradox had been satisfactorily explained by Tooke or Gibson, the assumptions behind the quantity theory of money and its derivatives would have been thrown into doubt before they became central to monetary policy.

MD: “Credit cycle”… read “farming operation”. With “real” money, savers would do their saving by putting their money under a rock. It is always safer there than with a bank … and banks would charge them (not pay them) if they convinced the savers otherwise. They did when they held gold dust for the prospectors’ safekeeping … and were proven unsafe when they “loaned” it out and couldn’t get it back.

This is a dramatic claim perhaps, but it might have demolished the suppositions behind the quantity theory of money, which became Fisher’s equation of exchange, and the brand of monetarism followed by the Chicago school under Milton Friedman.

MD: There’s plenty of demolition to go around in this article. Both the “pot” and the “kettle” are black … and are wrong.

Misleading ideas, such as velocity of circulation in the equation of exchange would have not been taken as meaningful economic indicators. As it is Gibson’s paradox is unknown to the majority of economists today, who assume the quantity theory of money is unchallengeable.

MD: If you believe in “money supply” you have to believe in “velocity of circulation”. It is a multiplier (just like the 10x leverage bankers give themselves). But to believe in “money supply” is to have a false belief.

So, to put the explanation of Gibson’s paradox at its simplest,

If the prices of goods are expected to rise, then their time preferences are bound to increase, and if they are expected to fall, their time preferences are bound to fall. That is why interest rates correlate with the price level.

MD: If the prices of “a good” rises, then the supply/demand balance for the good has decreased … and vice versa. If time preference compacts that demand (e.g. people wanting to see the movie in its first run rather than waiting for the DVD, that’s their choice). It’s a compaction of demand though … it’s not a time preference. It doesn’t result from money having time value.

And as George W. Bush observed, this was a scholarly article … even though it is easily proven to be totally misguided and misguiding. It has footnotes.

Click here to view the entire Whitepaper as a PDF…

1 J M KEYNES, A TREATISE ON MONEY, VOL.2 P.1981930

2 IRVING FISHER, THE THEORY OF INTEREST, 1930.

3 FRIEDMAN AND SCHWARTZ, FROM GIBSON TO FISHER, EXPLORATIONS IN ECONOMIC RESEARCH NBER VOL. 3,2 (SPRING)

4 KNUT WICKSEL, INTEREST AND PRICES, 1936, TRANSLATED FROM THE GERMAN, GELDZINS UND GUTERPREISER, 1898.

5 NBER WORKING PAPER SERIES NO. 1680 GIBSON’S PARADOX AND THE GOLD STANDARD, 1985.

6 J M KEYNES, THE GENERAL THEORY OF EMPLOYMENT, INTEREST AND MONEY, 1936.

7 JAMES TURK, THE ABOVEGROUND GOLD STOCK: ITS IMPORTANCE AND ITS SIZE SEPT 2012 HTTPS://WWW.GOLDMONEY.COM/IMAGES/MEDIA/FILES/GMYF/THEABOVEGROUNDGOLDSTOCK.PDF (ACCESSED JULY 2015)

8 CARL MENGER: GRUNDSÄTZE DER VOLKSWIRTSCHAFTSLEHRE (PRINCIPLES OF ECONOMICS)1871.

9 JM KEYNES: THE GENERAL THEORY OF EMPLOYMENT, INTEREST AND MONEY PP 376 OF THE 1936 EDITION.

The views and opinions expressed in this article are those of the author(s) and do not reflect those of GoldMoney, unless expressly stated. The article is for general information purposes only and does not constitute either GoldMoney or the author(s) providing you with legal, financial, tax, investment, or accounting advice. You should not act or rely on any information contained in the article without first seeking independent professional advice. Care has been taken to ensure that the information in the article is reliable; however, GoldMoney does not represent that it is accurate, complete, up-to-date and/or to be taken as an indication of future results and it should not be relied upon as such. GoldMoney will not be held responsible for any claim, loss, damage, or inconvenience caused as a result of any information or opinion contained in this article and any action taken as a result of the opinions and information contained in this article is at your own risk.

Clint Siegner is a Director at

Clint Siegner is a Director at

David Smith is Senior Analyst for

David Smith is Senior Analyst for