MD: For some time it has been obvious to me. If we should be a nation at all … and I think we would be better off if we were not … we should be a nation, not of men, not of laws (40,000+ new ones each year proves that); but of principles.

Turns out my views are not new. I tripped over Rochdale Principles today while researching electric cooperatives. Since and Medium of Exchange process is a cooperative process, lets see what we can learn from what is already known.

Here I annotate what Wikipedia has to say on the subject.

Rochdale Principles

The Rochdale Principles are a set of ideals for the operation of cooperatives. They were first set out in 1844 by the Rochdale Society of Equitable Pioneers in Rochdale, England and have formed the basis for the principles on which co-operatives around the world continue to operate. The implications of the Rochdale Principles are a focus of study in co-operative economics. The original Rochdale Principles were officially adopted by the International Co-operative Alliance (ICA) in 1937 as the Rochdale Principles of Co-operation. Updated versions of the principles were adopted by the ICA in 1966 as the Co-operative Principles and in 1995 as part of the Statement on the Co-operative Identity.[1]

Contents

- 1 Current ICA version of co-operative principles

Current ICA version of co-operative principles

The Rochdale Principles, according to the 1995 ICA revision, can be summarised as follows.[2]

Voluntary and open membership

The first of the Rochdale Principles states that co-operative societies must have an open and voluntary membership. According to the ICA’s Statement on the Co-operative Identity, “Co-operatives are voluntary organisations, open to all persons able to use their services and willing to accept the responsibilities of membership, without gender, social, racial, political or religious discrimination.”

MD: One might question the wisdom of allowing deadbeats (like governments) to be part of a Medium of Exchange, but a “proper” MOE process automatically excludes them anyway. When a trader is irresponsible, the interest load he must bear on his promises can preclude him from getting his promises certified as money.

This would be the case for “all” governments. They make promises but never deliver. They just roll them over.

Further, it brings up the question: Should any entity except individual traders be allowed to create money? I think not. Further, all traders creating money should be transparently authenticated and uniquely identifiable.

Anti-discrimination

To discriminate socially is to make a distinction between people on the basis of class or category. Examples of social discrimination include racial, religious, sexual, sexual orientation, disability, and ethnic discrimination. To fulfil the first Rochdale Principle, a Co-operative society should not prevent anyone willing to participate from doing so on any of these grounds. However, this does not prohibit the co-operative from setting reasonable and relevant ground rules for membership, such as residing in a specific geographic area or paying a membership fee to join, so long as all persons meeting such criteria are able to participate if they so choose.

MD: Setting ground rules “is” a form of discrimination. Singling out deadbeats and exposing them as such in a proper and transparent MOE process is a necessary method of maintaining the integrity of the process. Most “poor” people would be classified as deadbeats. Hopefully, with a proper MOE process, there would be few reasons (and excuses) for being poor.

If someone is willing to make a trading promise and deliver on it, they should be in no way inhibited from doing so. Further, if they default, they should be able to make up their default over any period of time (money having no time value in a proper process with guaranteed zero inflation) and completely clear their record … again becoming a responsible trader in the eyes of the process.

Motivations and rewards

Given the voluntary nature of co-operatives, members need reasons to participate. Each person’s motivations will be unique and will vary from one co-operative to another, but they will often be a combination of the following:

- Financial – Some co-operatives are able to provide members with financial benefits.

- Quality of life – Serving the community through a co-operative because doing service makes one’s own life better is perhaps the most significant motivation for volunteering. Included here would be the benefits people get from being with other people, staying active, and above all having a sense of the value of ourselves in society that may not be as clear in other areas of life.

- Giving back – Many people have in some way benefited from the work of a co-operative and volunteer to give back.

- Altruism – Some volunteer for the benefit of others.

- A sense of duty – Some see participation in community as a responsibility that comes with citizenship. In this case, they may not describe themselves as volunteers.

- Career experience – Volunteering offers experiences that can add to career prospects.

MD: This is a little too social for me. First, there is no such thing as “altruism”. Everyone, without exception, acts in their own self interest … all the time. Some just have little clue of what their self interest really is or should be. Further, the idea of a “sense of duty” is a con. It’s how you get people to enlist as cannon fodder as the elites play their global “war of worlds” game. Finally, I don’t agree with volunteering. Anyone who delivers a service should be compensated for it … if that service is worth something. A “proper” MOE process with media denominated in HULs (Hours of Unskilled Labor) makes the score keeping accurate, transparent, and fair. Notice that the above enumeration has elements of self interest sprinkled throughout.

Democratic member control

The second of the Rochdale Principles states that co-operative societies must have democratic member control. According to the ICA’s Statement on the Co-operative Identity, “Co-operatives are democratic organizations controlled by their members, who actively participate in setting their policies and making decisions. Men and women serving as elected representatives are accountable to the membership. In primary co-operatives members have equal voting rights (one member, one vote) and co-operatives at other levels are also organised in a democratic manner.”

MD: This doesn’t speak to the issue that democracy doesn’t work with more than 50 people involved. I favor representative control, where representatives are chosen by small groups comprised of no more than 50 people. If those people cannot deal with an issue, their representative is sent to the next lower level to a collection of no more than 50 people to deal with it there. At the layer directly below, 2,500 people are democratically represented (50 groups of 50). With this organization, the entire world’s population can easily be represented with just six layers … two times the current 6+ billion world population.

Member economic participation

Member economic participation is one of the defining features of co-operative societies, and constitutes the third Rochdale Principle in the ICA’s Statement on the Co-operative Identity. According to the ICA, co-operatives are enterprises in which “Members contribute equitably to, and democratically control, the capital of their co-operative.

MD: In reality this is nonsense … and unnecessary. Most people who “use” a MOE process media (money) don’t give a thought to how that money came into existence (though most have actually created money themselves).

At least part of that capital is usually the common property of the co-operative. Members usually receive limited compensation, if any, on capital subscribed as a condition of membership. Members allocate surpluses for any or all of the following purposes: developing their co-operative, possibly by setting up reserves, part of which at least would be indivisible; benefiting members in proportion to their transactions with the co-operative; and supporting other activities approved by the membership.” This principle, in turn, can be broken down into a number of constituent parts.

MD: Setting up of reserves is an actuarial concept. It is an inventory control concept … like safety stock. It’s just a technique … not a principle.

Democratic control

The first part of this principle states that “Members contribute equitably to, and democratically control, the capital of their co-operative. At least part of that capital is usually the common property of the co-operative.” This enshrines democratic control over the co-operative, and how its capital is used.

MD: This is starting to look like social gobledygook.

Limitations on member compensation and appropriate use of surpluses

The second part of the principle deals with how members are compensated for funds invested in a Co-operative, and how surpluses should be used. Unlike for-profit corporations, co-operatives are a form of social enterprise. Given this, there are at least three purposes for which surplus funds can be used, or distributed, by a Co-operative.

- “Members usually receive limited compensation, if any, on capital subscribed as a condition of membership.”

- “Developing their co-operative, possibly by setting up reserves, part of which at least would be indivisible;” in other words, the surplus can be reinvested in the co-operative.

- “Benefiting members in proportion to their transactions with the co-operative;” for example, a Consumers’ Co-operative may decide to pay dividends based on purchases (or a ‘divvi’).

- “Supporting other activities approved by the membership.”

MD: This again largely doesn’t apply to a proper MOE process. There is nothing to own. It’s not like a mutual insurance company where each insured shares the risk of all the others insured; when CLAIMS = PREMIUMS but money is made on investment income.

Autonomy and independence

The fourth of the Rochdale Principles states that co-operative societies must be autonomous and independent. According to the ICA’s Statement on the Co-operative Identity, “Co-operatives are autonomous, self-help organizations controlled by their members. If they enter into agreements with other organizations, including governments, or raise capital from external sources, they do so on terms that ensure democratic control by their members and maintain their co-operative autonomy.”

MD: There can be any number of “proper” MOE process in existence at any time. They are only proper if they have transparency attributes and controls that make them proper. And thus, as money creators, they are all equal. They are only distinguished by their efficiency. In practice they would all be denominated in units of HULs (Hours of Unskilled Labor).

Education, training, and information

The fifth of the Rochdale Principles states that co-operative societies must provide education and training to their members and the public. According to the ICA’s Statement on the Co-operative Identity, “Co-operatives provide education and training for their members, elected representatives, managers and employees so they can contribute effectively to the development of their co-operatives. They inform the general public – particularly young people and opinion leaders – about the nature and benefits of co-operation.”

MD: No education is needed. Any 3rd grader can easily grasp the concepts of a “proper” MOE process … if they don’t have to unlearn our “improper” MOE process first.

Cooperation among cooperatives

The sixth of the Rochdale Principles states that co-operatives cooperate with each other. According to the ICA’s Statement on the Co-operative Identity, “Co-operatives serve their members most effectively and strengthen the co-operative movement by working together through local, national, regional and international structures.”

MD: The concept of exchange doesn’t exist … it is 1.000 for all instances. But “discrimination” will be among the major tools each instance uses to be competitive. Thus discrimination is not only allowed … it is necessary for efficient and competitive operation.

Concern for community

The seventh of the Rochdale Principles states that co-operative societies must have concern for their communities. According to the ICA’s Statement on the Co-operative Identity, “Co-operatives work for the sustainable development of their communities through policies approved by their members.”

MD: A proper MOE process has no concern for community. It has only concern for perpetually delivering the attributes that defines the process: Transparency, authentication, free creation, mitigation of defaults immediately by like interest collection. That’s it.

It should be noted that “improper” MOE processes like Baltimore Green and Ithaca Hours are clueless when it comes to a “proper” MOE process … as is the Federal Reserve.

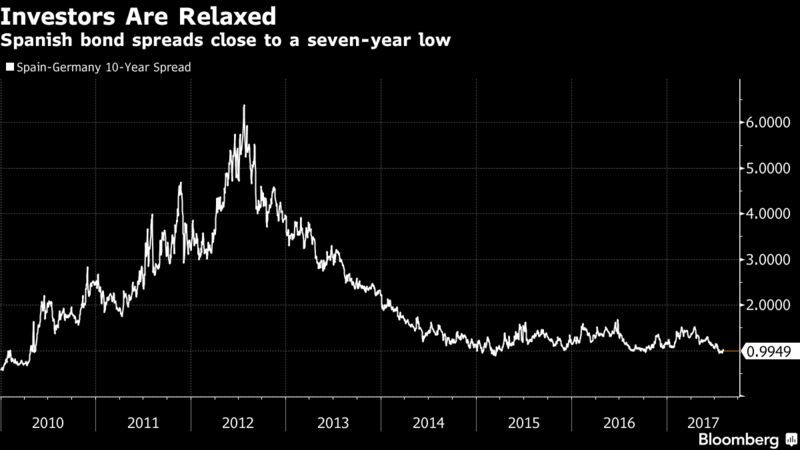

The last thing most Republican voters want is for McConnell and Ryan to start cutting deals with Nancy Pelosi and Chuck Schumer for a debt ceiling hike and MORE spending. But that may be exactly how this batch of sausage gets made. Watch for a coalition of big government Republicans and Democrats to leave future generations holding the bag – yet again.

The last thing most Republican voters want is for McConnell and Ryan to start cutting deals with Nancy Pelosi and Chuck Schumer for a debt ceiling hike and MORE spending. But that may be exactly how this batch of sausage gets made. Watch for a coalition of big government Republicans and Democrats to leave future generations holding the bag – yet again. Clint Siegner is a Director at

Clint Siegner is a Director at  While it is no doubt true that both the individual’s earning and expenditure patterns are conditioned to a large degree by the average patterns of his social group,

While it is no doubt true that both the individual’s earning and expenditure patterns are conditioned to a large degree by the average patterns of his social group,  Once we so much as move beyond the simple committee or town-meeting setting, however, something other than the passive response of suppliers [of public goods] must be reckoned with in any theory of politics that can pretend to model reality. Even if we take only the single step from town-meeting democracy to representative democracy, we must introduce the possible divergence between the interests of the representative or agent who is elected or appointed to act for the group and the interests of the group members themselves.

Once we so much as move beyond the simple committee or town-meeting setting, however, something other than the passive response of suppliers [of public goods] must be reckoned with in any theory of politics that can pretend to model reality. Even if we take only the single step from town-meeting democracy to representative democracy, we must introduce the possible divergence between the interests of the representative or agent who is elected or appointed to act for the group and the interests of the group members themselves.

The genius of Adam Smith and other eighteenth-century philosophers lay in their recognition of this coordinating characteristic of the exchange process, and in their explicit analysis of the precise manner in which such an economy would work. Smith showed that such an economy, if only allowed to work freely, in contrast to the network of mercantilist controls that governments of Europe imposed on their economies in the sixteenth and seventeenth centuries, would increase the “Wealth of Nations.”

The genius of Adam Smith and other eighteenth-century philosophers lay in their recognition of this coordinating characteristic of the exchange process, and in their explicit analysis of the precise manner in which such an economy would work. Smith showed that such an economy, if only allowed to work freely, in contrast to the network of mercantilist controls that governments of Europe imposed on their economies in the sixteenth and seventeenth centuries, would increase the “Wealth of Nations.” Indirectly, however, and in opportunity-cost terms, the empirical-nonempirical debate is of importance. The young and aspiring economist who becomes the expert empiricist has necessarily sacrificed training time in learning more about the process to which his highly polished technical tools are to be applied. These gaps in the training of modern economists are beginning to show up in many forms, not the least of which is the deadly dullness that dominates whole departments in many universities and colleges.

Indirectly, however, and in opportunity-cost terms, the empirical-nonempirical debate is of importance. The young and aspiring economist who becomes the expert empiricist has necessarily sacrificed training time in learning more about the process to which his highly polished technical tools are to be applied. These gaps in the training of modern economists are beginning to show up in many forms, not the least of which is the deadly dullness that dominates whole departments in many universities and colleges.

(go to link to see a picture of the shop)

(go to link to see a picture of the shop)