by Tyler Durden

Wed, 07/29/2020 – 22:05

MD: Note: There are charts embedded in this article which link back to the original. In time they will likely get broken.

MD: A proper MOE (Medium of Exchange or Money) Process treats all “traders” equally. But this instance does bring on to the stage an important case. What limits should be placed on the size of “promises” it will embrace…and why?

The case is fairly simple for individuals. It easily embraces the case for viable shelter (buying a house). It easily embraces the case for viable transportation (buying a car). It easily embraces the case for unanticipated medical needs (supplementing insurance). But how does it deal with the case for highly leveraged promises?

I will answer this question as I read the article and intersperse my comments. Hopefully it will address these issues. The most important issues are regarding “leverage” and detection of “rollovers”.

The only way to get really wealthy in any society is through unusual leverage.

Banks grant themselves 10x the leverage you and I have. As individuals we have no leverage. We work an hour…we make some number of HULS (note: HULs…Hours of Unskilled Labor… are the ideal MOE measure). We must be really really good at what we do (e.g. neurosurgery) to be worth 10x what we were in high school).

The mom and pop shop has almost no leverage. They “are” the business. But as they grow they hire help. And that is the beginning of their leverage growth. They take a piece of their workers’ labor as if they performed it themselves. As they grow they retain earnings but may also take on debt (i.e. they make money creating promises) or they take on partners (sell shares in their company). The money creating case is problematic. You can’t just say I want to create a car company and create $100B (or 10B HULS).

Then we have the financial wizards. They claim to be able to deploy surplus HULs better those who earn those HULs. And they take a piece of the action if they succeed. They don’t suffer if they fail; their clients do the suffering. They use options, derivatives, high speed trading, and myriad other tricks to multiply the natural leverage this game brings them.

Selling shares is not problematic. Each shareholder has to decide how he’s going to come up with the money to pay for his share. And the business itself decides how it will reward his participation. There are many games being played in this space to help mom and pop keep control as they grow. For example, they can give themselves options to buy shares as payment. They can mix debt and equity instruments as warrants. The options have proven to be inexhaustible…their consequences unknowable and unsupportable.

Such tactics are of no concern to the MOE process. Its only interest is in the “reasonableness” of the money creation and tracking its return and destruction. That means assessing the trader’s propensity to default and monitoring his performance in real time. And we know how to address such issues. We call them actuaries. They have great experience in the mutual casualty insurance business.

So now lets see how we address this very unusual but real instance of a threat to the MOE process. More importantly, we see how the MOE process places the responsibility exactly where it belongs…with the promise maker and with the process behavior. This characteristic gives some assurance of self discipline.

If the trader screws up, the trader must back his failed promise or he must pay the consequences (i.e. be banned from creating money…as we know all governments will be banned if they don’t change their behavior).

If the process screws up (i.e. supports an irresponsible trader), it must penalize oncoming traders (responsible or irresponsible) immediately. They pay INTEREST (which is returned if they prove to be responsible).

Now to the article. My interspersed comments appear formatted as this pretext is formatted. And please bear with me…I’m thinking through this as I write and it’s worth at least what you’re paying for it.

==================

Well, with everyone and everything else getting a bailout, may as well go all the way.

MD: What a remarkable opening. Is that like “if rape is inevitable, relax and enjoy it”?

Two months after we reported that the state of California is trying to turn centuries of finance on its head by allowing businesses to walk away from commercial leases – in other words to make commercial debt non-recourse – a move the California Business Properties Association said “could cause a financial collapse”, attempts to bail out commercial lenders have reached the Federal level, with the WSJ reporting that lawmakers have introduced a bill to provide cash to struggling hotels and shopping centers that weren’t able to pause mortgage payments after the coronavirus shut down the U.S. Economy.

MD: Well, the concept of “throwing good money after bad” is well known. And this likely falls into that category. Shopping malls have become a thing of the past. They had their 50years in the sun and have now been made obsolete by a better idea (.e.g. Amazon). The handwriting was on the wall way before the COVID-19 hoax and government lock-down suspended trade. COVID-19 is a neutron bomb attack. It kills people but doesn’t destroy things. For those still alive, a restart should be a simple process. Suspend the delivery on existing money creating promises until the external restrictions have been lifted. Continue to support new money creating promises using regular actuarial principles. Such principles will detect “rollover” attempts and reject them.

I think the obvious solution is to recognize the situation and do an “automatic extension” of promise time terms (the “time” part of the time and space spanning trade) of all affected promises, and move painlessly on down the road. Nobody gets hurt.

The bill would set up a government-backed funding vehicle which companies could tap to stay current on their mortgages. It is meant in particular to help those who borrowed in the $550 billion CMBS market in which mortgages are re-packaged into bonds and sold to Wall Street. What it really represents, is a bailout of the only group of borrowers that had so far not found access to the Fed’s various generous rescue facilities: and that’s where Congress comes in.

MD: The problem as expressed here does not exist with a proper MOE process. Money is not “backed” by anything but the process. So there is no such thing as a CMBS market or mortgage-backed securities and bonds. If we had a proper MOE process, such techniques could still exist for those who want the risk of non-responsible traders. But that is no concern or responsibility of the money process. And the phrase “government-backed funding vehicle” is a marker. This is not a viable proposal with the word “government” in it.

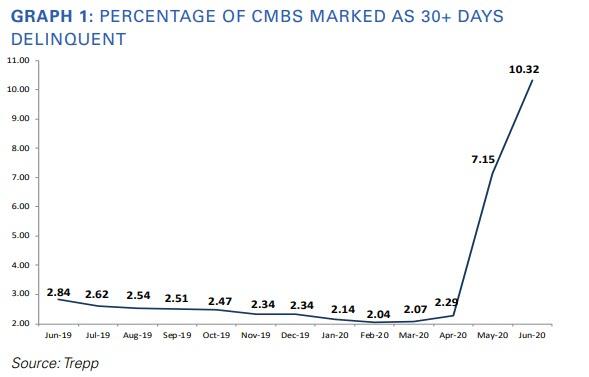

To be sure, the commercial real estate market is imploding, and as we reported at the start of the month, some 10% of loans in commercial mortgage-backed securities were 30 or more days delinquent at the end of June, including nearly a quarter of loans tied to the hard-hit hotel industry, according to Trepp LLC.

MD: And if those leases were taken on by trader created money, then an automatic 30 day extension would have already been applied to their promise. Such extensions could go on indefinitely. There are no so-called investors involved at all. Mom and pop created the money (they created money for the full lease as if it was a purchase…but is paid out to the seller monthly) and this is one of those unavoidable occurrences that the money process naturally accommodates. Loan sharks anticipate this too. They take the property. Moving these leases into the MOE process space stops the domino effect such instances create.

MD: The above curve illustrates the superiority of the MOE process solution. In April, the COVID-19 hoax lock down occurred. Up until then the market was healthy and getting more healthy. Then wammo!. With the MOE process, the above curve would go flat…or maybe even continue to go down. And a new curve would start up. That curve would be the automatic extensions of the time component of the money creating promises. There is no pain to anyone anywhere…and everyone is still responsible for their promise. Note, this concept also applies to floor plans purchased in anticipation of normal business sales performance…now interrupted by the lock down. Such provisions are now provided by banks through lines of credit or compensating balance loans…and they profit exorbitantly.

“The numbers are getting more dire and the projections are getting more stern,” said Rep. Van Taylor (R., Texas), who is sponsoring the bill alongside Rep. Al Lawson (D., Fla.).

MD: In our system “sponsoring a bill” means “bowing to a lobbyist”. That’s how our corrupt system works. That’s what gives the wealthy so much leverage over the mom and pops. A proper MOE process levels the playing field…at no cost or risk to anyone.

Van Taylor (R-Texas) is sponsoring the bill to aid hotels and shopping centers.

Under the proposal, banks would extend money to help these borrowers and the facility would provide a Treasury Department guarantee that banks are repaid. The funding would come from a $454 billion pot set aside for distressed businesses in the earlier stimulus bill.

MD: You’ve got to love that phrase “banks would extend money”. Folks. The banks don’t have money. They have a 10x leverage privilege. A proper MOE process makes that privilege unnecessary. Let the banks continue to exist if they want to. But the 10x privilege is an anachronism.

Richard Pietrafesa owns three hotels on the East Coast that were financed with CMBS loans. They have recently had occupancy of around 50% or less, which doesn’t bring in enough revenue to make mortgage payments, he said.

MD: And here is a case where we have to ask: where does the money come from? When you buy a house over time you can securely make that money creating promise. You know what you expect to make and purchase a house accordingly. But if the income is interrupted its your problem to find a replacement for it.

But Pietrafesa has no way of replacing his interruption. Such deals are heavily leveraged (OPM…other people’s money). He couldn’t get the MOE process to allow this money creating trade in the first place. He would have to rely on forming a collective to get his hotel deal done. And if the collective fails, well, as individuals in the collective, they have an incentive to keep it from failing or they lose their share. The MOE process may allow their trading promise to Pietrafesa…but would not allow Pietrafesa’s promise to the owner of the hotel he purchased. For example, just like buying a house with time payments, they could actuarially show they could buy a piece of a hotel with time payments…and be responsible if it fails.

He said he is now two months behind on payments for one of his properties, a Fairfield Inn & Suites in Charleston, S.C. He has money set aside in a separate reserve, he said, but his special servicer hasn’t allowed him to access it to make debt payments.

MD: Here we have the domino effect. He’s paying a “special servicer” to cover this risk. He’s buying insurance. It’s an actuarial problem. And insurance companies are the ultimate leveragor. In insurance CLAIMs = PREMIUMS. The money is made on the investment income. But with a real MOE process which guarantees zero INFLATION, investment income can’t benefit from the leverage INFLATION gives. The insurance business becomes a risk mitigation business with a proper MOE process…as it should be.

“It’s like a debtor’s prison,” Mr. Pietrafesa said.

MD: An MOE process does not have a provision for penalizing. It only has a provision for naturally ostracizing. Pietrafesa would have to pay INTEREST if he DEFAULTs and tries to create money again. And he has to make up that DEFAULT to become a responsible money creating trader again. It’s the natural negative feedback stabilizing loop of the process.

Those magic words, it would appear, is all one needs to say these days to get a government and/or Fed-sanctioned bailout. Because in a world taken over by zombies, failure is no longer an option.

MD: These days are no different than other days. In the olden days the zombies were taken over by the Rothschilds…through their J.P.Morgan agency. It was and is a protection racket…just like the mafia runs. A proper MOE process removes the leverage and drives them out of business…kind of like legalizing drugs drives those dealers them out of that business. Ultimately, people need to be responsible for their own stupidity…but not for the stupidity of others.

While any struggling commercial borrower that was previously in good financial standing would be eligible to apply for funds to cover mortgage payments, the facility is designed specifically for CMBS borrowers.

MD: Thus, the leverage is in the ability to lobby. Such advantage needs to be eliminated…in a very natural, not legislative, manner. A proper MOE process goes far in enabling that.

It gets better, because not only are taxpayers ultimately on the hook via the various Fed-Treasury JVs that will fund these programs, but the new money will by default be junior to existing insolvent debt. As the Journal explains, “many of these borrowers have provisions in their initial loan documents that forbid them from taking on more debt without additional approval from their servicers. The proposed facility would instead structure the cash infusions as preferred equity, which isn’t subject to the debt restrictions.“

MD: The taxpayers are not on the hook. Our current process with no stabilizing negative feedback will just keep escalating until it blows itself up. Then most people (not in the inner circle with advance warning) lose; it resets; and starts all over again…with the insiders picking up the pieces for pennies on the dollar. We now pay over 3/4ths of what we earn to governments. Where does communism begin? Where does slavery begin?. It’s not a good system folks. We’ve been duped. And praising the constitution and wrapping ourselves in the flag is not going to fix it. It was broken when it was installed…the anti-federalists got it right but lost the argument.

Yes, it’s also means that the new capital is JUNIOR to the debt, which means that if there is another economic downturn, the taxpayer funds get wiped out first while the pre-existing debt – the debt which was unreapayble to begin with – will remain on the books!

MD: When a building collapses, it’s kind of immaterial whether the lower floors or the upper floors collapse first. When this calamity happens, the dirt this house of cards stands on is the only thing of value.

Perhaps sensing the shitstorm that this proposal would create, the WSJ admits that “the preferred equity would be considered junior to other debt but must be repaid with interest before the property owner can pull money out of the business.”

MD: And this is how we get 40,000 new laws every year. They start with a bad process (i.e. principles diluted by laws) and are stuck with a huge maintenance problem.

What was left completely unsaid is that the existing impaired CMBS debt will instantly become money good thanks to the junior capital infusion from – drumroll – idiot taxpayers who won’t even understand what is going on.

MD: “will instantly become money”: Let’s examine this. We know what money is. So somehow he’s saying that some trader instantly makes a promise spanning time and space here. Who’s the trader, the taxpayer? Well that’s no different than what we have now with government doing perpetual rollovers of their trading promises. That’s not money creation. That’s counterfeiting. We already know that.

How did this ridiculously audacious proposal come to being? Well, Taylor led a bipartisan group of more than 100 lawmakers who last month signed a letter asking the Federal Reserve and Treasury to come up with a solution for the CMBS issues. Treasury Secretary Steven Mnuchin and Fed Chairman Jerome Powell have indicated that this may be an issue best addressed by Congress.

MD: “asking the Federal Reserve and Treasury to come up with a solution”? They’re the problem. Institute a proper MOE process and we drive out the problem. That allows us to address issues in a “proper” context rather than an “opportunist” context.

In other words, while the Fed will be providing the special purpose bailout vehicle, it is ultimately a decision for Congress whether to bail out thousands of insolvent hotels and malls.

MD: The malls have no future. They are the buggy whip of a previous era. They need to be plowed under and reseeded. But the hotels are viable. They are just suspended in time. If they’re collectively owned they are the responsibility of the members of the collective. They are suspended in time. They are not failing. And suspension carries no cost in this instance except maintenance. Remember, with a propper MOE process, money has zero time value.

Failure? That’s something else again. It all get’s back to the individual traders’ responsibility and recourse. A proper MOE process should allow small traders to create money to tide themselves over the temporary situation. It should not support large highly leveraged traders to do so. It’s an actuarial problem.

And if some in the industry have warned that an attempt to rescue the CMBS market would disproportionately benefit a handful of large real-estate owners, rather than small-business owners, it is because they are precisely right: roughly 80% of CMBS debt is held by a handful of funds who will be the ultimate beneficiaries of this unprecedented bailout; funds which have spent a lot of money lobbying Messrs Taylor and Lawson.

MD: Handful of “funds”. What is a fund but a collective… where the manager gets the gains and the participants get the losses. People who buy into a fund roll their own dice. When the fund is a pension fund, only the pensioner should have control. With perpetual zero inflation, placing their pension under a rock is a viable solution.

Of course, none of this will be revealed and instead the talking points will focus on reaching the dumbest common denominator. Taylor said the legislation is focused on – what else – saving jobs. What he didn’t say is that each job that is saved will end up getting lost just months later, and meanwhile it will cost millions of dollars “per job” just to make sure that the billionaires who hold the CMBS debt – such as Tom Barrack who recently urged a margin call moratorium in the CMBS market – come out whole.

MD: Saving jobs “is” the issue. These workers are suspended in time. It’s their responsibility to provide for themselves. They can do this by creating money to tide themselves over (say for a year or two if necessary). A proper MOE process could actuarially support this money creation.

Say we have the maitre-d of the hotel restaurant. It’s pragmatic for him to span this interruption and go back to work as if nothing happened. So he creates a time and space spanning money creating promise. He creates two years of normal income to be paid back 1/100th monthly. The payback begins two years hence and proceeds 100 months. When he goes back to work he begins paying back, essentially cutting his own salary a manageable amount. And while suspended, he can put up dry-wall and make some pin money.

For the bar-back it’s a little different. He may make a money creating promise covering 3 months income to be paid back monthly beginning in three months over a two year span. And he immediately goes looking for a replacement job…maybe putting up dry-wall. His job is not his “career”.

“This started with employees in my district calling and saying ‘I lost my job’,” Taylor said, clearly hoping that he is dealing with absolute idiots.

MD: An idiot institutes processes that have built in domino effect.

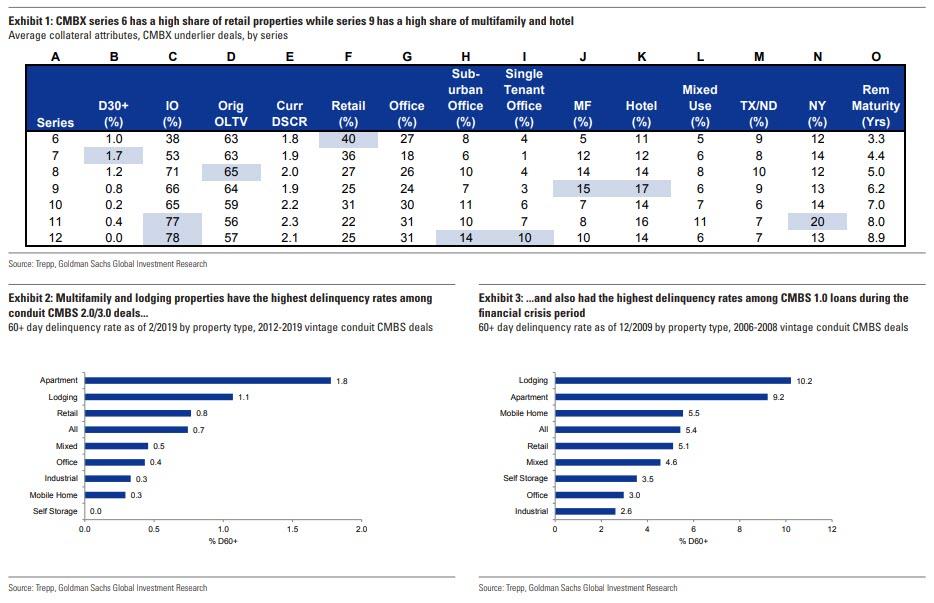

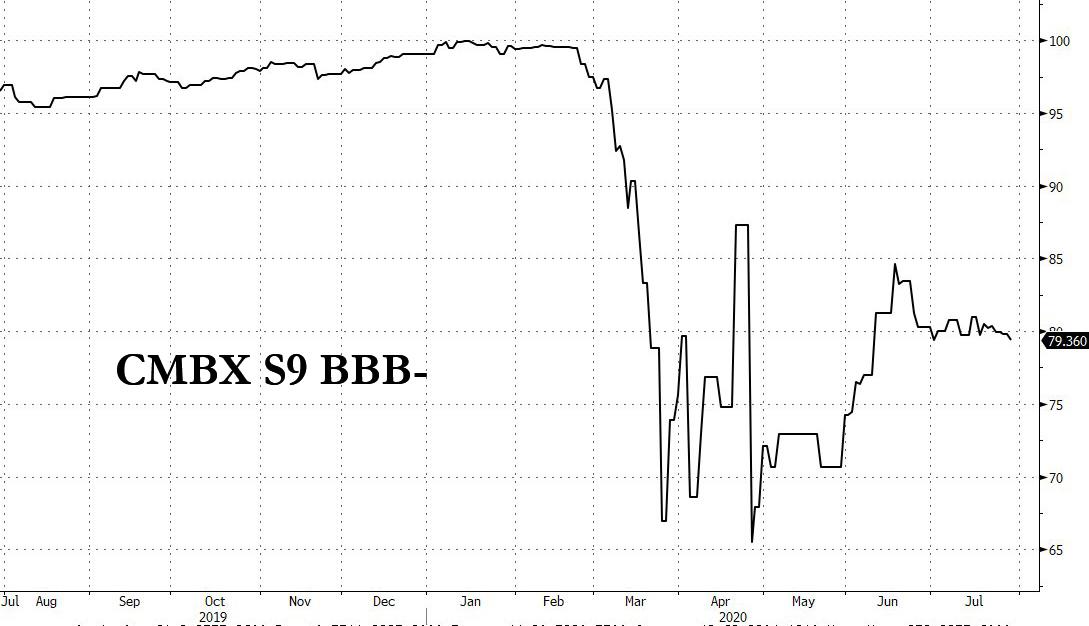

And while it is unclear if this bill will pass – at this point there is literally money flying out of helicopters and the US deficit is exploding by hundreds of billions every month so who really gives a shit if a few more billionaires are bailed out by taxpayers – should this happen, well readers may want to close out the trade we called the “The Next Big Short“, namely CMBX 9, whose outlier exposure to hotels which had emerged as the most impacted sector from the pandemic.

MD: The money flying out of the helicopters is counterfeit. It will go directly to producing INFLATION. It will only create taxes to the extent the money-changers demand their tribute payments…that’s where “all” taxes go.

With a proper MOE process the domino effect is mitigated; a natural stabilizing negative feedback mechanism prevails; and a pragmatic self controlled recovery is instituted. Remember. When you have a government solution to a problem, you just have the same problem multiplied and are still looking for a solution.

Alternatively, those who wish to piggyback on this latest egregious abuse of taxpayer funds, this crucifxion of capitalism and latest glorification of moral hazard, and make some cash in the process should do the opposite of the “Next Big Short” and buy up the BBB- (or any other deeply impaired) tranche of the CMBX Series 9, which will quickly soar to par if this bailout is ever voted through.

MD: And the real character of so-called “investors” is revealed and amplified. Without a proper MOE process, money is the chips in an opportunist, privileged casino called capitalism. Traderism is where real money lives.

MD: So here we have another good example where a proper MOE process doesn’t “treat” a problem; rather it anticipates it and prevents its effect.