https://www.zerohedge.com/crypto/ethereum-co-founder-responds-swedens-cashless-society-rethink

Ethereum Co-Founder Responds To Sweden’s Cashless-Society Rethink

MD: We never know what we’re going to get into with these “cyber money” articles. Looks like someone’s having reservations about how well it works. And is it correct to refer to it as “cashless”?

If I have a $100 bill and I take it to a gas station and trade it for a tank of gas and $50 in change that’s a “cash” transaction. The gas station now has a $100 bill in their cash register. And they have one less $50 bill there. Further, they have $50 less gas in their buried tank. And I have $50 worth of gas in my truck. And I have a $50 bill in my wallet where I once had a $100 bill.

Now, does anything change if I give the gas station a debit card… or a credit card… or the gas station’s own branded credit card? It’s all just accounting. It’s all just moving “cash” around. Or is it? There’s an important distinction between a “debit” card and a “credit” card.

With a “debit” card, you have something keeping track of “cash you have”. With a “credit” card you have something keeping track of “cash you create”… cash you “don’t” have… cash you must return to complete your promise. Cash you have is an “in process promise to complete a trade spanning time and space” You don’t know who made that promise. You do know it wasn’t you. You are using it as the most common object in simple barter exchange.

But what about the “credit” card. It’s about “cash you create”. And when you “create” cash, “you” are making the “promise to complete a trade spanning time and space.” And it is “you” who must deliver on that promise. But it’s still cash. It’s still money. But it’s not money “you” have. It’s money the creator of the credit card has. These are terms referring to the same thing. At the end of the month you “pay” off your credit card… usually by making a deposit in an account. And what do you deposit in the account? Probably a check from your employer.

And that check from your employer… what is that? It’s a token that will eventually take cash out of his account and transfers it into your account. That is now a principal function of a bank. It’s a banking function that they charge you for.

In the beginning, it was no function of a bank at all. The function of a bank was to keep people from stealing your valuables… whether in a safe deposit box, or in their vault holding gold and silver… things people “believe” to have value. And you paid the bank for that safe keeping. And in the end, the bank occasionally lost your gold and silver… and said “sorry… it’s gone!”

So, are we clear what “cash” is? Are we clear that the term “cashless” is meaningless?

by Tyler Durden

Wednesday, May 28, 2025 – 02:30 AM

Authored by Ezra Reguerra via CoinTelegraph.com,

As Sweden reconsiders its push toward a cashless society, Ethereum co-founder Vitalik Buterin highlighted the fragility of centralized digital payments and the opportunity presented by decentralized payment alternatives.

MD: “Fragility of centralized digital payments”. I think this is the “thesis statement” of this article. Let’s keep it in mind as we proceed.

In recent years, Sweden has led the charge toward a cashless future, with digital payment platforms becoming widespread. However, as concerns over cyber-threats, civil defense and instability have emerged, Swedish authorities are now actively encouraging citizens to keep some cash.

MD: What he’s really saying is “keep your cash as stuff rather than as numbers in a ledger”. And is a token representing numbers in a ledger stuff? Well, we’re seeing how confused these geniuses are, aren’t we.

Buterin noted the reversal illustrates that while centralized solutions may be efficient, they may not be reliable during times of crisis.

MD: If tokens (i.e. stuff) representing numbers in a ledger is not a “centralized solution”, then what is it? Would it be better to call it a “universal” solution? I think so.

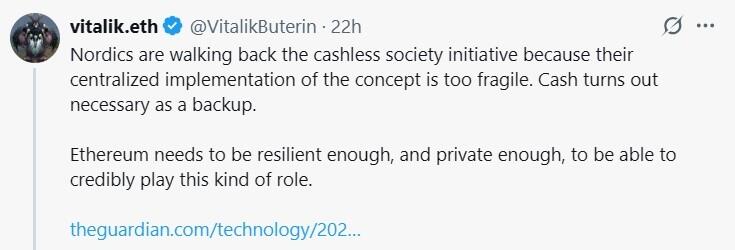

“Nordics are walking back the cashless society initiative because their centralized implementation of the concept is too fragile,” Buterin wrote, citing a March 16 article by The Guardian. “Cash turns out necessary as a backup.”

Source: Vitalik Buterin

How Ethereum can play a role in a crisis

MD: Ethereum claims to be money. It falsely assumes that by keeping track of “pure waste” of electricity, money is created. And Ethereum is the ledger that keeps track of that. It’s obviously silly… but that’s the concept. They call it “proof of work”. And now they’re suggesting that that number in the ledger is actually worthless… even though it stands for actual waste. And as a backup, you should keep some “cash”. Now tell me, where did the cash come from?

A former central bank official predicted in 2018 that Sweden would be cashless after seven years. In 2025, the prediction mostly held, with only one in 10 transactions in the country being done in cash, according to The Guardian.

MD: This “one in 10” is probably a made up statistic. Do you really think it’s somebody’s job to keep track of so-called “cash” transactions as distinct from “non-cash” transactions?

Still, while the Nordic country was an early adopter of digital payments, its government published a brochure encouraging citizens to keep a week’s worth of cash in case of war or crisis. Sweden’s reconsideration has revealed the issue of centralized digital payment infrastructure remaining reliable in times of instability, Buterin suggested.

MD: “… in case of war or crisis…” This suggests that this ethereum stuff disappears or is otherwise inaccessible in some situations. And this isn’t true of what they’re calling cash… which is presumably “currency” and “coin”… tokens that don’t disappear for some reason. That suggests, if we are to have a truly cashless society, we need an indelible record. Could an SD card be made to act like an indelible record? It could if it could be encrypted with a password that only the owner knows. An invention is needed here.

Buterin said Ethereum can be a decentralized financial fallback in times of crisis. “Ethereum needs to be resilient enough, and private enough, to be able to credibly play this kind of role,” Buterin said.

MD: Seems to me what we need is a process that moves numbers from one ledger to another ledger with no central authority. That’s what needs to be invented.

When asked if fully offline zero-knowledge technology-secured private transfers were close to practical implementation, Buterin said the tech know-how is already there, but there are still limitations:

“We basically know how to do it, but with the limitation that any solution depends on trusted hardware and/or post hoc enforcement against double-spenders.”

MD: So basically what is it he thinks he knows how to do then?

Crypto payments exec thinks crypto won’t replace fiat

MD: Oh please! What’s with this “fiat”? See how their improper use of terms just throws a wrench in the works?

While crypto payment solutions are becoming more common, Mercuryo co-founder and CEO Petr Kozyakov has said that crypto will not replace fiat.

MD: And did his say that, somehow knowing everybody knew what he was talking about? Does everybody know what this “fiat” term means?

Kozyakov told Cointelegraph in an interview that crypto payments are seeing an increase in demand and adoption.

However, the executive said that instead of cryptocurrencies fully replacing fiat money as a payment method, the two payment options will coexist.

MD: Is that different than saying “cash” and “currency” and “checks” and “credit cards” and “debit cards” and ATM machines should coexist?

Kozyakov told Cointelegraph that people will use crypto when it’s easier and more practical.1,1375

MD: What makes it “hard” and “less practical”? Are these people of value? Are they paid (i.e. do other people give money to them for putting out this nonsense). How advanced must a society become to be so confused about value?